Bitcoin inflows surge to $436 million while ETF volumes remain below average

Bitcoin inflows surge to $436 million while ETF volumes remain under average

Bitcoin inflows surge to $436 million while ETF volumes remain under average Bitcoin inflows surge to $436 million while ETF volumes remain under average

The principal inflows bear been linked to altering market sentiments for a 50 basis level hobby rate lower.

Duvet art/illustration by CryptoSlate. Portray involves combined hiss material which would possibly presumably consist of AI-generated hiss material.

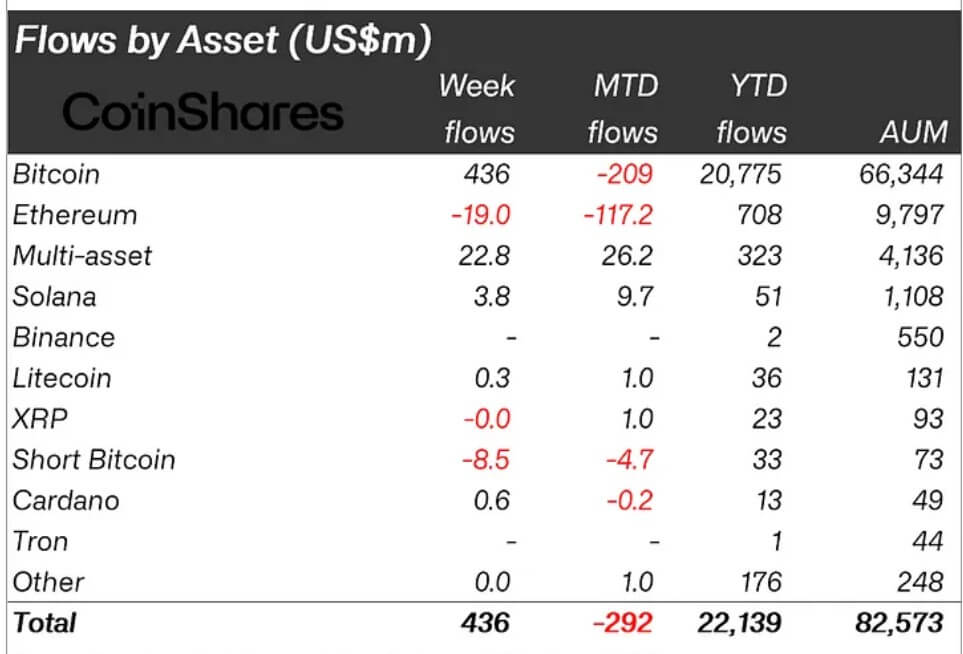

Crypto investment merchandise experienced a pointy turnaround perfect week, with inflows reaching $436 million to partly reverse weeks of old outflows totaling $1.2 billion, in step with CoinShares‘ most modern weekly file,

Whatever the influx, ETF trading volumes remained flat at $8 billion, severely lower than the yearly average of $14.2 billion.

What caused the inflows?

James Butterfill, CoinShares’ head of be taught, attributed the shift to altering market expectations for a doubtless 50 basis level hobby rate lower on Sept. 18.

This came after remarks by William Dudley, outmoded president of the Federal Reserve Monetary institution of Unusual York, at the Bretton Woods Committee’s annual Future of Finance Dialogue board in Singapore.

Dudley argued that a 50 basis level lower develop into as soon as warranted, citing a weakening US labor market. He highlighted that job risks outweighed inflationary considerations to abet his demand a reduce worth.

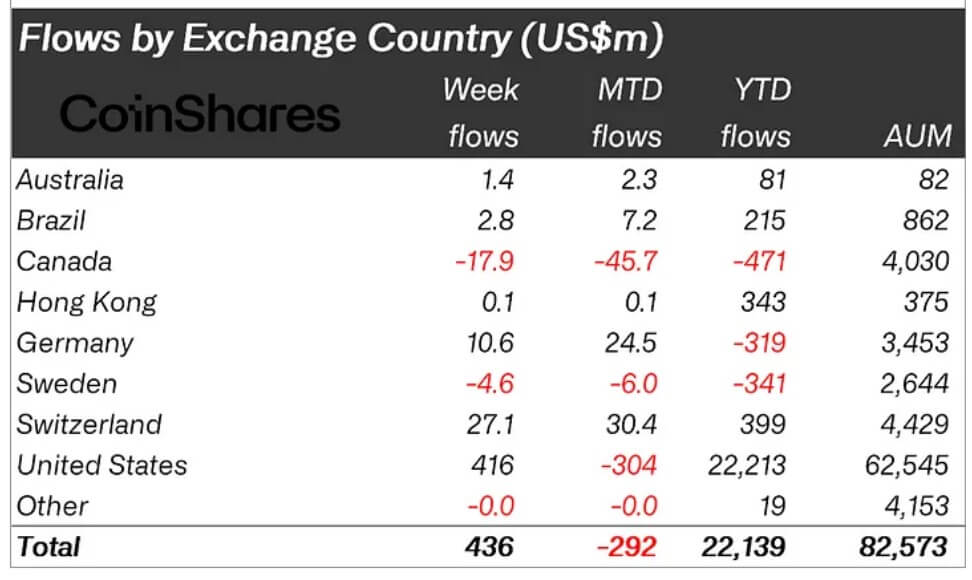

Attributable to those altering sentiments, the US observed inflows totaling $416 million, with Switzerland and Germany moreover seeing inflows of $27 million and $10.6 million, respectively.

On the diversified hand, Canada observed outflows totaling $18 million at some level of the duration.

Bitcoin surges while Ethereum struggles

Bitcoin observed the best inflows, with $436 million, marking a reversal afterten0 days of outflows totaling $1.18 billion. Conversely, short-Bitcoin merchandise observed outflows of $8.5 million after three consecutive weeks of inflows.

Ethereum faced $19 million in outflows. This downturn stems from considerations about Layer-1’s profitability following the March Dencun enhance. Market observers bear important a ninety 9% decline in Ethereum’s mainnet earnings since March 2024.

The upward push of Layer-2 (L2) networks, boosted by the Dencun enhance’s lower costs, has made L2 solutions more titillating. Analysts warn that if this pattern continues, L2 networks would possibly presumably dominate and presumably shift away from Ethereum’s mainnet, especially for particular person applications.

Meanwhile, Solana marked its fourth consecutive week of inflows, totaling $3.8 million. Litecoin and Cardano moreover observed inflows, with a combined total of about $900,000.

In addition to, blockchain equities observed inflows of $105 million following the originate of just a few unique ETFs in the US.

Talked about on this text

Source credit : cryptoslate.com