The SEC ‘regrets confusion’ it may have invited stating some tokens are securities

The SEC ‘regrets confusion’ it would possibly maybe well most likely maybe comprise invited bringing up some tokens are securities

The SEC ‘regrets confusion’ it would possibly maybe well most likely maybe comprise invited bringing up some tokens are securities The SEC ‘regrets confusion’ it would possibly maybe well most likely maybe comprise invited bringing up some tokens are securities

Chief valid officer at Coinbase questions SEC's historical stance on tokens as securities.

Quilt art work/illustration by capability of CryptoSlate. Image involves mixed content material that would possibly maybe maybe well encompass AI-generated content material.

The US Securities and Alternate Fee (SEC) has filed an amended criticism in opposition to Binance within the District of Columbia, introducing procedural updates and valid modifications to its long-established filing.

The modification, licensed this morning, involves a motion below Federal Rule of Civil Direction of 15(a)(2), accompanied by a memorandum explaining the explanations for the adjustments, a proposed amended criticism, and a redline version highlighting the alterations.

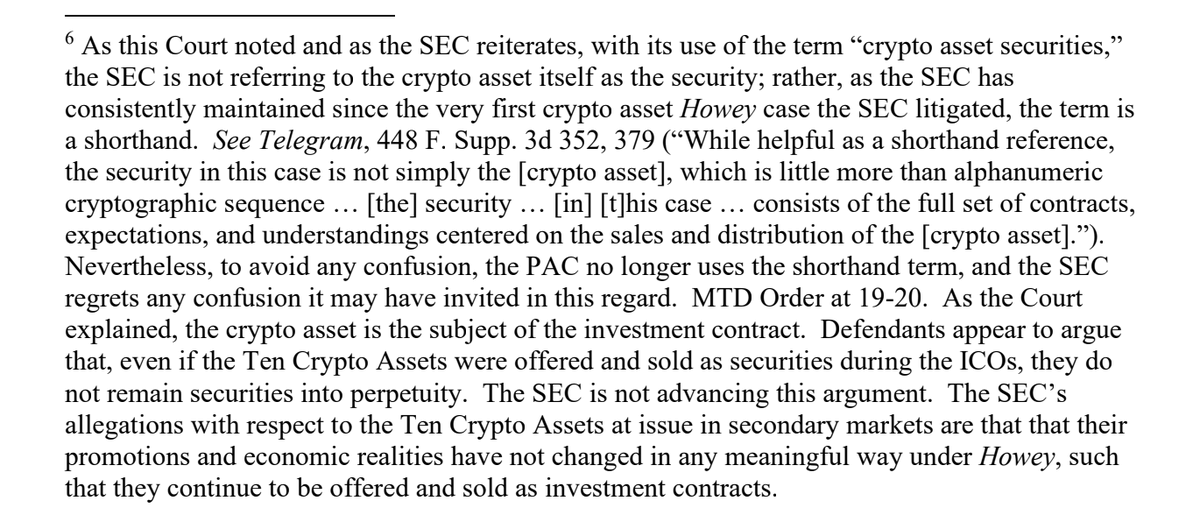

Paul Grewal, Chief Apt Officer at Coinbase, commented on the SEC’s amended criticism by capability of social media. “The SEC regrets any confusion it would possibly maybe well most likely maybe comprise invited by falsely and over again and over again bringing up that tokens themselves are securities,” he eminent, highlighting Footnote 6 of the amended criticism. He puzzled the SEC’s longstanding region, bringing up,

“The SEC absolutely ‘maintained’ that tokens themselves are securities is apparent from the prolonged record of their laws by enforcement marketing campaign. Why misinform the Court docket?”

Grewal shared an extract from the criticism, which clearly states the SEC’s admittance of remorse.

Grewal moreover addressed the SEC’s capability to Ethereum (ETH) transactions, noting the agency’s lack of readability on how ETH transactions comprise meaningfully changed in comparison to other digital resources below scrutiny.

He remarked,

“By some capability ETH transactions comprise changed in a meaningful plan that the Ten Crypto Sources comprise no longer so to preserve a ways from the agency’s clutches. How? That’s it sounds as if for the SEC to perceive, and the comfort of us to search out out perfect if and when we're sued.”

Per the amended criticism, the filing references additional documents, in conjunction with an order denying the defendants’ motion to push apart in a associated case, SEC v. Payward, Inc. (Kraken). Procedural time closing dates had been command, with Binance and its co-defendants required to answer by October 11, both opposing the SEC’s motion or filing a gaze of consent.

Apt analysts indicate that the SEC’s modification would be an are trying to bolster its case amid criticisms referring to regulatory readability. The agency has faced ongoing scrutiny from swap contributors who argue that its enforcement actions lack transparent pointers for what constitutes a security in crypto.

Binance has been below regulatory rigidity from the SEC, which alleges that the platform operated unregistered securities exchanges and misled merchants. The swap has constantly denied these allegations, placing forward its commitment to compliance and cooperation with regulators.

The cut-off date for Binance and its co-defendants to acknowledge the SEC’s amended criticism objects the stage for a big valid war of words sooner than the US election, the receive crypto laws is changing into an increasing number of necessary.

The swap’s request for regulatory readability continues to develop, with many calling for definitive pointers in its receive of enforcement actions as the important capability of laws.

Talked about on this article

Source credit : cryptoslate.com