MicroStrategy buys $1.1 billion in Bitcoin amid market volatility

MicroStrategy buys $1.1 billion in Bitcoin amid market volatility

MicroStrategy buys $1.1 billion in Bitcoin amid market volatility MicroStrategy buys $1.1 billion in Bitcoin amid market volatility

MicroStrategy's Bitcon wager has introduced a 17% yield year-to-date for its shareholders.

Quilt artwork/illustration via CryptoSlate. Image contains mixed mutter material that can also consist of AI-generated mutter material.

MicroStrategy obtained approximately 18,300 Bitcoin for $1.1 billion between Aug. 6 and Sept. 12 at an sensible impress of $60,408 per BTC, per a Sept. 13 submitting with the US Securities and Substitute Fee (SEC).

Coinflip files exhibits the firm’s most modern possess already has a paper loss of $2.2 million because of the high digital asset’s present volatility.

Funding

The agency acknowledged that the possess used to be funded by selling greater than 8 million firm shares via a gross sales agreement with quite a lot of monetary institutions, including TD Securities, The Benchmark Company, BTIG, Canaccord Genuity, Maxim Community, and SG Americas Securities.

The capital raised from these gross sales used to be straight ancient to maintain greater its Bitcoin holdings.

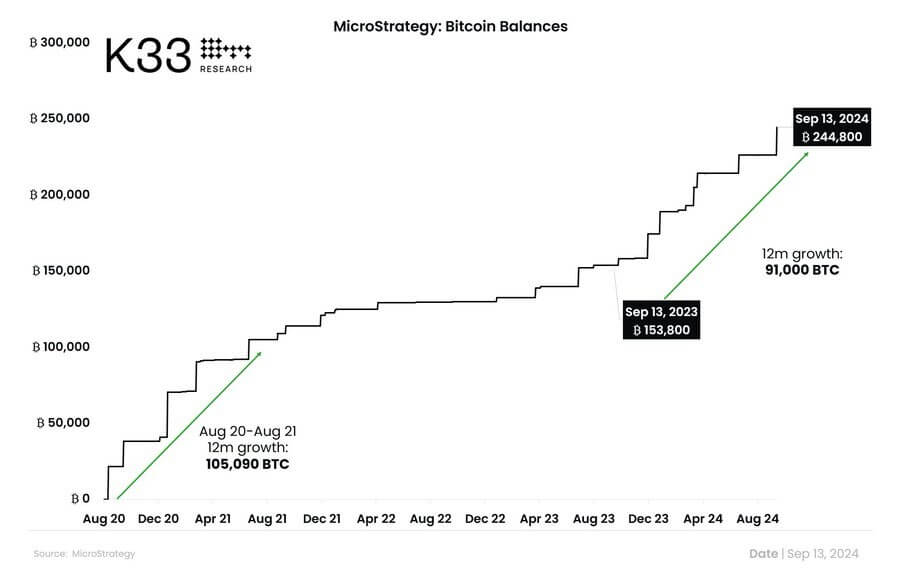

Particularly, the agency has pursued this funding approach aggressively in the course of the previous year to gather the high digital asset. K33 Learn acknowledged that the agency has sold round 91,000 BTC between Sept. 2023 and as of late.

It added:

“August 2020-21 is the top interval featuring a elevated YoY enhance in MSTR’s BTC exposure of 105,090 BTC.”

Meanwhile, this most modern acquisition introduced MicroStrategy’s complete Bitcoin holdings to 244,800 BTC, valued at over $14 billion right this moment prices. The firm’s complete investment in Bitcoin is $9.forty five billion, with an sensible possess impress of $38,585 per Bitcoin.

Saylortracker files signifies the agency holds an unrealized income of greater than $4 billion.

Bitcoin yield

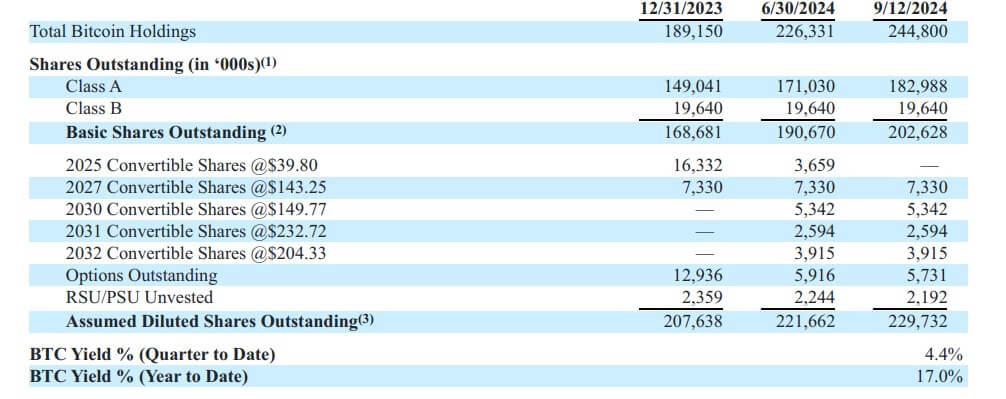

MicroStrategy Executive Chairman Michael Saylor reported a Bitcoin yield of 4.4% for this quarter and 17% year-to-date on its holdings.

Basically essentially based entirely on the SEC submitting, this key performance indicator (KPI) helps assess the agency’s approach for acquiring Bitcoin. The BTC yield metric tracks the percentage trade over time in the ratio of MicroStrategy Bitcoin holdings to diluted shares.

The firm believes this measure can make stronger investors’ working out of its technique to fund Bitcoin purchases thru issuing additional shares or convertible instruments.

Despite files of the most modern possess, MicroStrategy’s shares stay flat in premarket trading. However, it has risen 91% year-to-date.

Talked about listed right here

Source credit : cryptoslate.com