Digital assets suffer as Bitcoin leads $726 million outflow

Digital sources endure as Bitcoin leads $726 million outflow

Digital sources endure as Bitcoin leads $726 million outflow Digital sources endure as Bitcoin leads $726 million outflow

The CoinShares document showed that Ethereum and Bitcoin faced heavy outflows, while Solana seen surprising beneficial properties.

Duvet art/illustration by means of CryptoSlate. Articulate entails mixed announce which can well additionally honest consist of AI-generated announce.

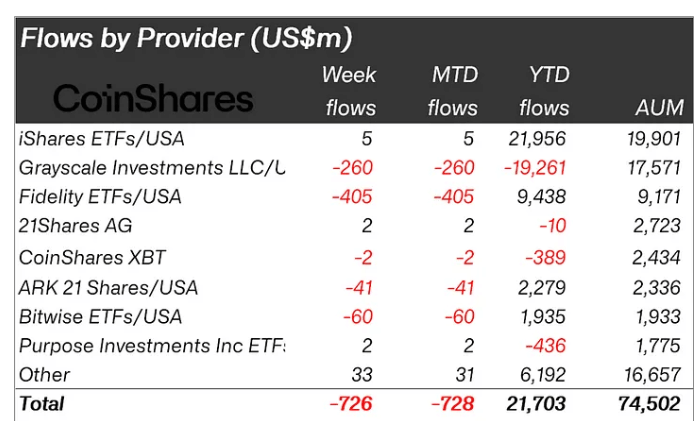

Digital asset investment products seen foremost outflows totaling $726 million, matching the ultimate outflow recorded earlier this 365 days in March, per CoinShares‘ latest document.

James Butterfill, head of learn at CoinShares, attributed this harmful sentiment to stronger-than-anticipated macroeconomic records from the old week. This increased the probability of a 25-basis level curiosity charge hike by the US Federal Reserve.

He added:

“On an everyday basis outflows slowed later in the week as employment records fell quick of expectations, leaving market opinions on a attainable 50bp charge lower extremely divided. The markets are actually looking at for Tuesdayâs Person Label Index (CP|) inflation document, with a 50bp lower extra doubtless if inflation comes in beneath expectations.”

US, Bitcoin lead outflows

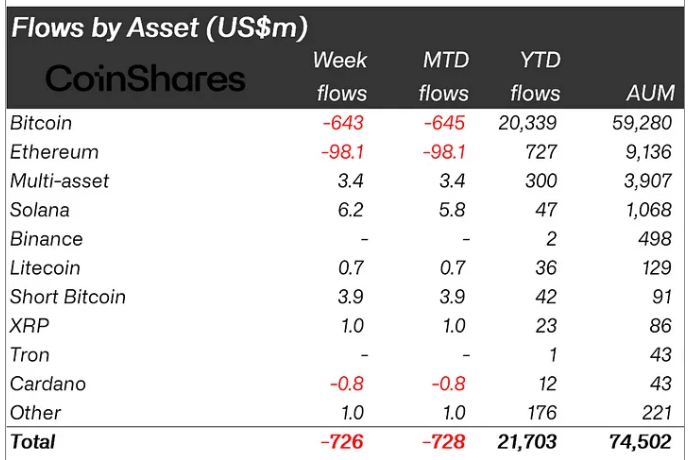

Bitcoin led the outflows, losing $643 million, bringing its month-to-month outflows to $645 million. Short BTC funds, however, seen minor inflows of $3.9 million.

Meanwhile, US Bitcoin commerce-traded funds (ETFs) seen an eight-day outflow wander, inflicting win outflows of $721 million in the country. Fidelity’s FBTC fund was as soon as accountable for most of this, with $405 million in outflows final week.

It was as soon as followed by Grayscale’s GBTC, which seen $280 million in outflows. Bitwise ETFs executed the highest three for final week with losses of around $60 million.

Canada also recorded outflows of $28 million. In distinction, Europe had extra obvious sentiment, with Germany and Switzerland seeing inflows of $16.3 million and $3.2 million, respectively.

Altcoins endure contrasting fates.

Ethereum-based fully investment products recorded $98 million in win outflows final week.

This was as soon as basically this ability that of Grayscale’s transformed ETHE fund, which misplaced $111 million all around the period. This meant the minimal inflows into other place Ethereum ETF products could no longer offset the foremost outflows, further fuelling concepts that there was as soon as no ask for these investment products.

Then any other time, Solana-based fully investment products secured $6.2 million in win inflows, the largest amongst digital asset products.

Varied digital sources like Cardano seen outflows of around $800,000 despite finishing the first section of its extremely anticipated Chang Difficult Fork. In comparability, Litecoin and XRP products seen cumulative inflows of $1.7 million.

Mentioned listed here

Bitcoin

Bitcoin  Ethereum

Ethereum  Solana

Solana  XRP

XRP  Litecoin

Litecoin  CoinShares

CoinShares  Grayscale Investments

Grayscale Investments  Fidelity Investments

Fidelity Investments  Bitwise

Bitwise  Bitwise Bitcoin ETF

Bitwise Bitcoin ETF  Grayscale Bitcoin Trust

Grayscale Bitcoin Trust  Grayscale Ethereum Trust

Grayscale Ethereum Trust  Fidelity Shiny Origin Bitcoin Trust

Fidelity Shiny Origin Bitcoin Trust

Source credit : cryptoslate.com