No, Bitcoin trading is not older than fiat or the US stock market, yet

No, Bitcoin buying and selling is now now not older than fiat or the US stock market, yet

No, Bitcoin buying and selling is now now not older than fiat or the US stock market, yet No, Bitcoin buying and selling is now now not older than fiat or the US stock market, yet

Bitcoin has extra buying and selling hours than put up-Nixon US stock market but can now now not match centuries of fiat history.

Duvet art/illustration by procedure of CryptoSlate. Image involves blended teach material that can encompass AI-generated teach material.

Bitcoin’s buying and selling hours hang surpassed these of the stylish US fiat stock market since the Nixon Shock, but claims of it exceeding the total history of US stock buying and selling or fiat globally would be premature. A more in-depth examination finds a extra nuanced image of market longevity and buying and selling exercise.

The crypto crew now now not too long in the past buzzed with a statistic highlighting how Bitcoin had collected extra buying and selling hours than the fiat stock market following an evaluation by Cory Bates.

Bates identifies how Bitcoin buying and selling has now surpassed the fiat stock market, but it indubitably’s vital to be conscious that this does now now not mean the total US stock market history. Unruffled, it would possibly well even be derived that Bitcoin buying and selling is older than fiat buying and selling in the US. It is rarely, nonetheless, older than fiat globally.

The earliest known spend of fiat currency was once in China at some level of the Tune Dynasty (960â1279 CE). The authorities issued paper money now now not backed by bodily commodities admire gold or silver. This currency was once before every part backed by the issue’s credit rating and grew to turn out to be broadly accepted for trade and taxation.

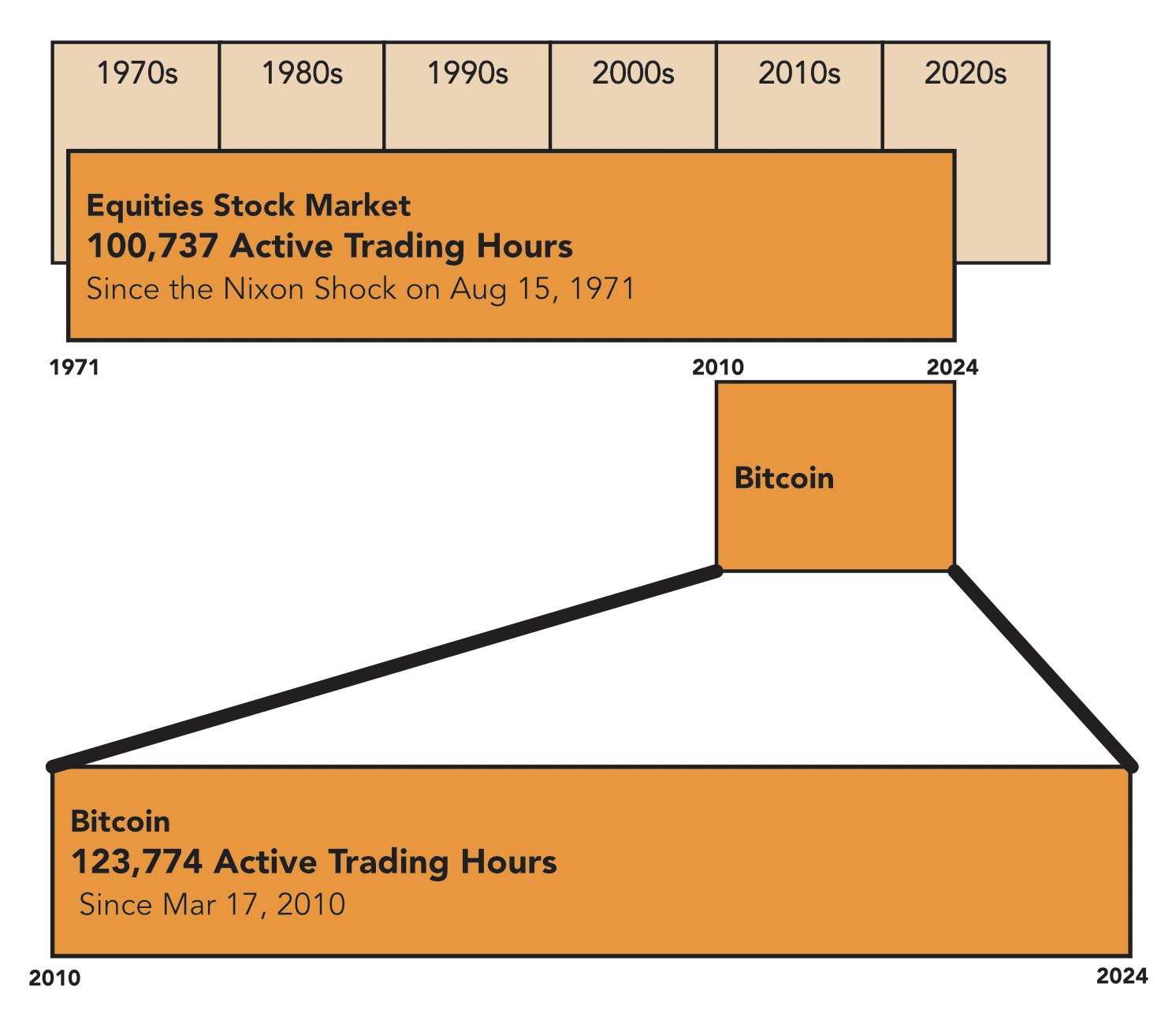

Bitcoin buying and selling hours vs US fiat stock market

Bitcoin, launched in 2009, has accumulated 123,774 energetic buying and selling hours since its first recorded trade on March 17, 2010. This surpasses the 100,737 hours logged by US equities markets since August 15, 1971 â the date of the Nixon Shock, which marked a primary shift in world monetary systems by procedure of the removal of the gold abnormal.

On the different hand, the US stock market’s history extends a ways past 1971. The Original York Stock Change, founded in 1792, has a legacy spanning over two centuries. When accounting for this complete history, the image changes dramatically.

Calculations in accordance to the NYSE’s founding date expose roughly 380,509 energetic buying and selling hours as a lot as September 6, 2024. This figure dwarfs Bitcoin’s most up-to-date tally regardless of the digital asset’s 24/7 buying and selling agenda.

Bitcoin’s round-the-clock availability provides it a primary advantage in amassing buying and selling hours. The pale stock market operates on a extra restricted agenda, in most cases 6.5 hours per day, 5 days a week, with the exception of for holidays.

Given Bitcoin’s continuous buying and selling, projections present this would possibly occasionally rob till round April 15, 2053, for the digital asset to indubitably surpass the total buying and selling hours of the US stock market’s complete history. This assumes both markets continue working under their most up-to-date schedules without significant disruptions.

On the different hand, it’s important to present that buying and selling hours on my own attain now now not entirely capture market depth, liquidity, or total economic influence. The US stock market stays a cornerstone of world finance, with a depth and breadth of listed companies and buying and selling quantity that Bitcoin has yet to compare.

While Bitcoin has made extraordinary strides in its instant existence, the paunchy weight of the US stock market’s centuries-long history stays a formidable benchmark.

A total history of fiat money buying and selling

Bitcoin’s roam, although mercurial, gentle has a protracted time to lunge sooner than it will in actuality hiss to hang outlasted the cumulative buying and selling hours of America’s storied stock markets. Extra, when assessing the hiss that it has also surpassed fiat, forex markets were readily accessible 24 hours a day on weekdays since 1971.

Estimating the total buying and selling hours for fiat currency globally offers a diversified converse as a consequence of the staggered historical adoption of fiat systems. While fiat currency in some create has been used since extinct China, unique buying and selling hours fully grew to turn out to be consistent in the 20th century, namely after the transition a ways from the gold abnormal following the Nixon Shock in 1971.

Earlier than 1971, world buying and selling hours had been localized, irregular, and diversified between regions. At the same time as fiat systems grew to turn out to be extra overall, there was once no unified world buying and selling market, and exchanges operated with restricted hours. On the different hand, after 1971, the emergence of the international exchange (forex) market grew to turn out to be a extra legitimate benchmark for calculating buying and selling hours.

At the present time, unique forex buying and selling operates roughly 120 hours per week (24 hours a day, 5 days a week). The usage of this as a baseline, it would possibly well even be estimated that since 1971, there were about 6,240 hours of fiat buying and selling per 365 days. Over the Fifty three years from 1971 to 2024, that would possibly well quantity to roughly 330,720 buying and selling hours for fiat in unique world markets.

In summary, whereas Bitcoin has surpassed the put up-1971 US fiat equities market in terms of buying and selling hours, the cumulative buying and selling hours of world fiat buying and selling since the inception of organized world forex markets are vastly elevated.

Thus, Bitcoin has now now not surpassed the total world buying and selling hours of fiat currenciesâneither in terms of most modern forex buying and selling nor when pondering the deep history of fiat money globally. Unruffled, unless major forex markets are also opened for weekends, Bitcoin would possibly well theoretically rating up at most spicy. On the different hand, Some brokerages enable restricted weekend buying and selling for basically the most well-most widespread forex pairs.

Source credit : cryptoslate.com