Ethereum’s network revenue plunges by 99%, sparking ‘death spiral’ concerns

Ethereum’s network income plunges by 99%, sparking ‘loss of life spiral’ concerns

Ethereum’s network income plunges by 99%, sparking ‘loss of life spiral’ concerns Ethereum’s network income plunges by 99%, sparking ‘loss of life spiral’ concerns

Coinbase-backed Corrupt network paid most appealing $11,000 to Ethereum in August no topic generating virtually $2.5 million income.

Quilt art/illustration by capacity of CryptoSlate. Image entails mixed converse material that would possibly well per chance merely consist of AI-generated converse material.

Ethereum’s layer-1 network has witnessed a drastic decline in income, plummeting by 99% since March 2024.

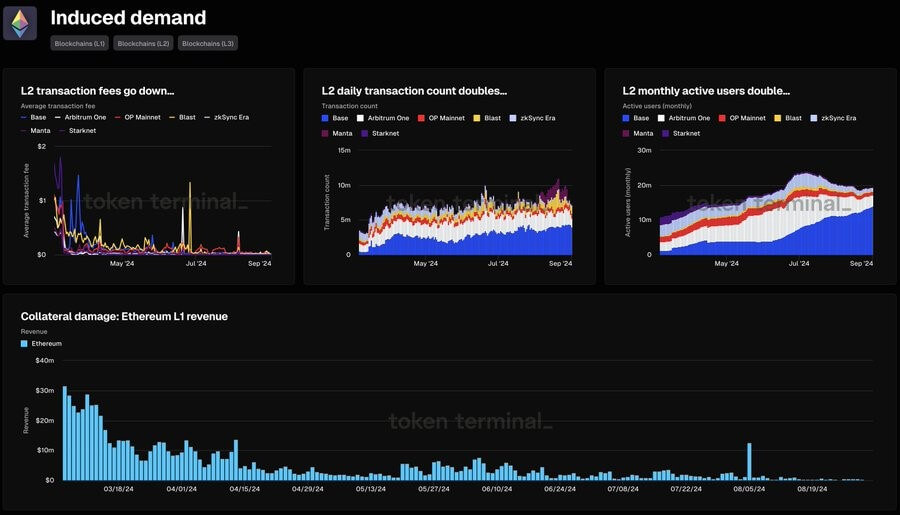

Data from Token Terminal unearths that network income peaked at over $35 million on March 5. On the opposite hand, by Sept. 2, on a regular foundation income had plunged to a yearly low of spherical $200,000.

Market observers attribute this decline to the boost of layer-2 (L2) networks and the March Dencun upgrade, which lowered charges for L2 transactions and reshaped Ethereum’s income constructing. Token Terminal stated:

“Key metrics that expose how decrease transaction charges on L2s have elevated usage, nonetheless additionally driven down the income on the L1.”

Post-upgrade transaction relate has shifted from Ethereum’s mainnet to L2 networks, main to elevated on a regular foundation transactions and vigorous customers on these platforms.

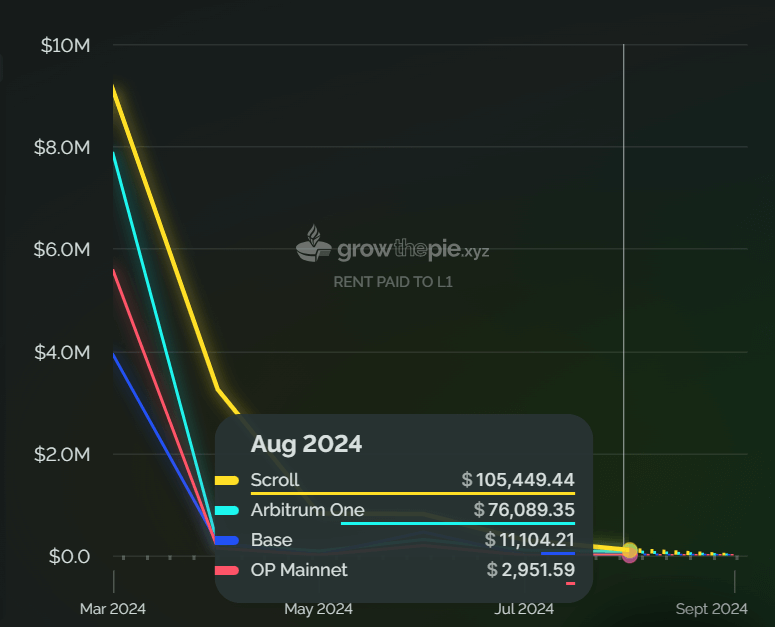

On the opposite hand, this migration has vastly impacted Ethereum’s price income. For event, Coinbase’s L2 network, Corrupt, generated $2.5 million in income in August nonetheless paid most appealing $11,000 to decide on the mainnet, underlining the shift in impress from Ethereum’s irascible layer.

Crypto analyst Kun warned that if this fashion continues, L2 networks would possibly well per chance dominate and presumably abandon Ethereum’s mainnet, especially for person capabilities. He emphasised the necessity for Ethereum to style precious use cases on its mainnet or trouble a severe valuation anxiousness.

He added:

“ETH L1 needs precious use cases on mainnet that can't be sieged or it is miles a must must hope that L2 usage is so spacious that on the total you must per chance like 100000 times the usage on L2 to salvage the same impress you did on mainnet with a small fragment which then creates a valley of valuation problems.”

‘Death spiral’

Bitcoin investor Fred Krueger has echoed these concerns, suggesting that Ethereum would possibly well per chance face a “loss of life spiral” if its low income situation persists.

He pointed out that Ethereum’s contemporary price income of $200,000 per day equates to $73 million yearly, some distance from ample to retain its market cap of $300 billion.

Krueger argues that a more realistic valuation would possibly well per chance very well be nearer to $3 billion, underscoring the disconnect between Ethereum’s price income mannequin and its market valuation. He stated:

“[Ethereum is] no longer linked to an organization making $73 million a year in income, and even an organization making $73 million a year in income. That $73 million is no longer even ample to aquire relieve your complete inflation that naturally involves ETH validators.”

Talked about on this article

Source credit : cryptoslate.com