USDC crosses $16 trillion in volume, driven by Solana’s market share

USDC crosses $16 trillion in quantity, driven by Solana’s market half

USDC crosses $16 trillion in quantity, driven by Solana’s market half USDC crosses $16 trillion in quantity, driven by Solana’s market half

USDC is the 2nd-largest stablecoin by market cap and now accounts for a valuable quantity of stablecoin's overall quantity.

Quilt art/illustration by CryptoSlate. Image involves mixed pronounce that might presumably even simply include AI-generated pronounce.

Circle’s USD Coin (USDC) stablecoin has crossed the $16 trillion ticket in full cumulative quantity.

Whereas this number falls wanting venerable monetary powerhouses like Visa, which processed over $12 trillion in funds true closing year, it highlights the outstanding boost of stablecoins. No topic their pretty short existence, stablecoins have quick established themselves as key players in the realm monetary market.

Stablecoins play an a truly foremost role in the crypto ecosystem. They facilitate the tender transfer of funds, toughen seamless trading between tokens, and enable funds, especially for extreme-border transactions.

Launched in 2018, USDC is the 2nd-largest stablecoin by market capitalization, with $34.6 billion at exclaim in circulation. Circle has strategically positioned USDC as a extra regulatory-compliant stablecoin, differentiating it from opponents like USDT.

This form has contributed to USDC’s dominance in transactions this year, surpassing Tether’s USDT despite having a smaller circulating provide. Constant with Artemis, USDC now accounts for roughly 50% of the full stablecoin transaction quantity.

Solana fuelling USDC’s boost

USDC’s transaction quantity is essentially driven by the Solana blockchain, which holds extra than three-quarters of the stablecoin market half. Facts from DeFiLlama signifies that USDC makes up about 65% of Solana’s $3.98 billion stablecoin provide.

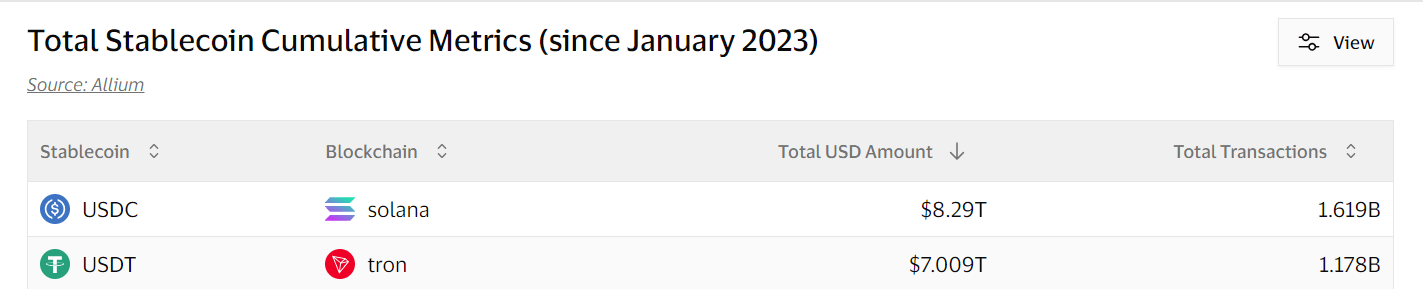

A stablecoin dashboard created by Visa Inc., in collaboration with Allium Labs, reveals that USDC’s transaction quantity on Solana has soared to approximately $8.29 trillion since the initiating of closing year. Its nearest rival, USDT on TRON, seen a quantity of $7 trillion for the duration of the same timeframe.

This boost isn’t ultimate, given Solana’s reputation for its proceed and lower transaction charges, which have attracted curiosity from venerable monetary players like PayPal.

The novel surge in memecoin trading and DeFi actions on Solana has further propelled its upward push. Over the past few months, the market has even viewed cases when trading activity on Solana surpassed Ethereum’s.

Talked about on this text

Source credit : cryptoslate.com