Nasdaq-listed Semler Scientific boosts Bitcoin holdings above 1000 BTC to become top 20 holder

Nasdaq-listed Semler Scientific boosts Bitcoin holdings above 1000 BTC to change into high 20 holder

Nasdaq-listed Semler Scientific boosts Bitcoin holdings above 1000 BTC to change into high 20 holder Nasdaq-listed Semler Scientific boosts Bitcoin holdings above 1000 BTC to change into high 20 holder

Semler Scientific has change into one of high 20 company Bitcoin holders with its most up-to-date aquire.

Quilt art/illustration by the utilization of CryptoSlate. Image involves combined insist material which may per chance also encompass AI-generated insist material.

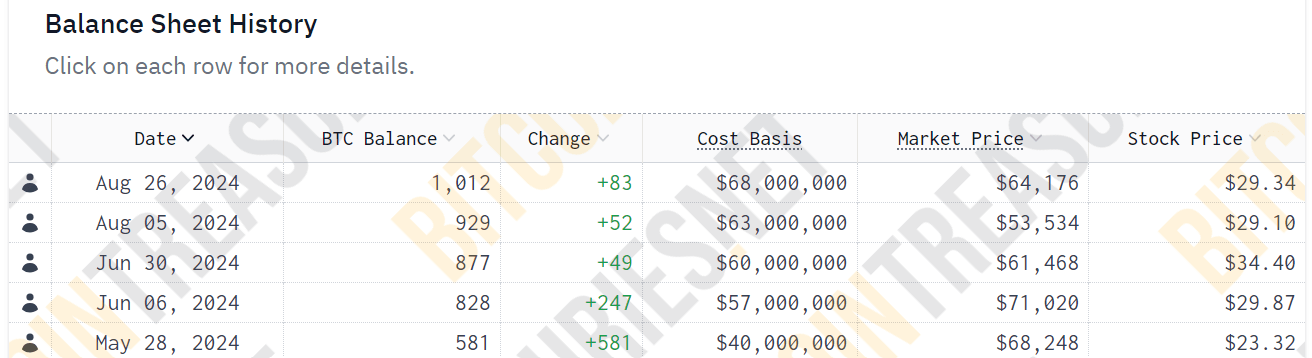

Nasdaq-listed clinical technology agency Semler Scientific has expanded its Bitcoin holdings by procuring an further 83 BTC for $5.0 million, in retaining with an Aug. 26 statement.

This acquisition brings the firm’s total Bitcoin holdings to 1,012 BTC, obtained at a cumulative price of $68 million, alongside with fees and fees.

The firm’s chairman, Eric Semler, explained that the acquisition became primarily funded via cash generated from the agency’s operations and supplemented by funds from its at-the-market equity program.

He added:

“We're inspired by the increasing institutional adoption of Bitcoin. It became currently reported that institutions now dangle bigger than 20% of Bitcoin ETF resources under management. We imagine this rising institutionalization will pressure price for both Bitcoin prices and our shareholders.”

Semler Bitcoin purchases

Semler Scientific began investing in Bitcoin in Would per chance when it obtained 581 BTC for $40 million.

Since then, the firm has persisted its procuring spree, procuring 247 BTC for $17 million on June 6 and 49 BTC for $3 million on June 28. By Aug. 5, the agency had bought an further 52 BTC for one other $3 million.

With the latest aquire, Semler Scientific now ranks among the many tip 20 company Bitcoin holders, in retaining with Bitcoin Treasuries data.

In the 2nd quarter document, CEO Doug Murphy-Chutorian reaffirmed the firm’s dedication to Bitcoin, emphasizing that it complements its healthcare trade method.

Institutional adoption

Semler’s increasing Bitcoin stash highlights the rising self belief among firms in the command of the flagship digital asset as a treasury reserve.

This style, which became kicked off by MicroStrategy in 2020, has won noteworthy momentum this year, with other firms, like Japan-based funding firm Metaplanet and publicly listed DeFi Applied sciences, making essential Bitcoin acquisitions.

Moreover, the introduction of Bitcoin trade-traded fund (ETF) products has resulted in a main originate bigger in institutional publicity to the rising trade. Bitwise CIO Matt Hougan predicted that this style would extra originate bigger in the arriving years as the trade continues to outmoded.

Mentioned listed right here

Source credit : cryptoslate.com