Norwegian sovereign wealth fund’s indirect Bitcoin holdings soar 62% in first half of 2024

Norwegian sovereign wealth fund’s oblique Bitcoin holdings waft 62% in first half of of 2024

Norwegian sovereign wealth fund’s oblique Bitcoin holdings waft 62% in first half of of 2024 Norwegian sovereign wealth fund’s oblique Bitcoin holdings waft 62% in first half of of 2024

The fund increased its holdings in diverse Bitcoin-linked corporations luxuriate in MicroStrategy and Marathon Digitals.

Duvet artwork/illustration by strategy of CryptoSlate. Image entails blended declare which may per chance honest include AI-generated declare.

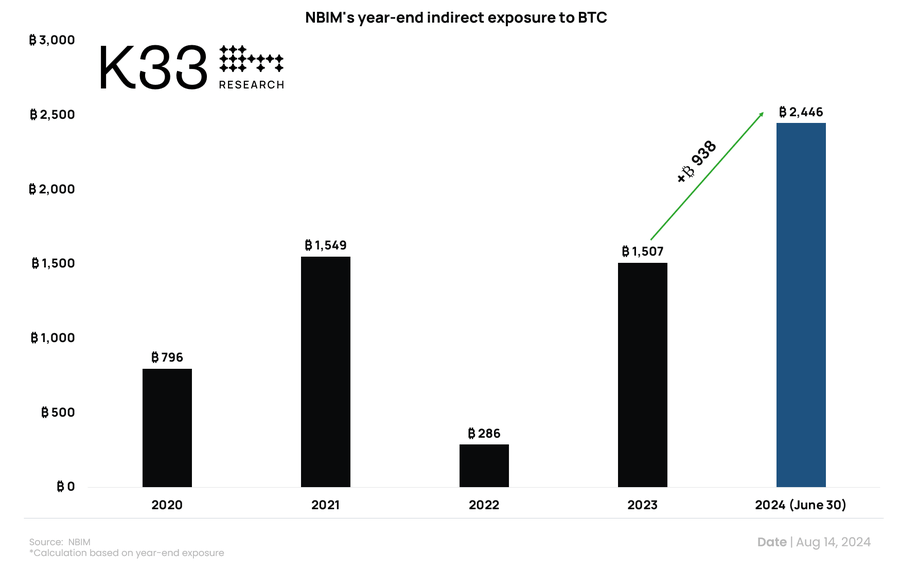

The Norwegian Authorities Pension Fund, in most cases known as the Oil Fund, has oblique exposure to Bitcoin that rose by 62% at some level of the well-known half of of this three hundred and sixty five days to the identical of two,446 BTC, per the Senior Analyst at K33 Be taught Vetle Lunde.

This equates to an make bigger of 938 BTC since December 2023, when the firm circuitously held the identical of 1,507 BTC.

The Norwegian Pension Fund is the area’s biggest sovereign wealth fund, with property amounting to $1.7 trillion, per its most modern reports.

NIBM’s Bitcoin exposure

Lunde attributed this narrate more to automatic sector adjustments and threat diversification than a deliberate diagram to make bigger Bitcoin holdings.

He outlined:

“[This increase was] unlikely to stem from an intentional diagram to amass exposureâif increased BTC exposure became as soon as the goal, we’d glance more proof of narrate exposure initiatives (and vastly increased exposure).”

In the intervening time, the fund’s Bitcoin exposure comes from investments in main Bitcoin-linked corporations, alongside side MicroStrategy, Marathon Digital, Coinbase, and Block Inc.

In the well-known half of of 2024, the fund’s stake in MicroStrategy rose from 0.67% to 0.89%, as MicroStrategy boosted its holdings in Bitcoin terms by 37,181 BTC. Additionally, the fund increased its shares in Coinbase from 0.49% to 0.83% and Block Inc from 1.09% to 1.28%. It also added a 0.82% house in Marathon Digital.

Lunde identified that the fund’s oblique Bitcoin exposure amounted to 44,476 sats (approximately $27) per capita on the top of the three hundred and sixty five days’s first half of.

Assorted funds exposure

The Norwegian fund’s exposure to Bitcoin aligns with recent trends seen in varied pension funds, such as the Wisconsin Pension Fund, which own also increased their exposure to the top crypto.

Market observers noted that these investments reflect the rising acceptance of BTC as a viable different investment. This shift started earlier this three hundred and sixty five days after web web page online Bitcoin alternate-traded fund (ETF) merchandise had been introduced within the US, making the asset class a viable option amongst frail investors.

Lunde outlined that these strikes showed that “Bitcoin is maturing as an asset and getting woven into any properly-varied portfolio!”

Talked about on this text

Source credit : cryptoslate.com