PlanB’s Stock-To-Flow model off by $130k, Bitcoin trades below trend since 2021

PlanBâs Inventory-To-Waft mannequin off by $130k, Bitcoin trades under model since 2021

PlanBâs Inventory-To-Waft mannequin off by $130k, Bitcoin trades under model since 2021 PlanBâs Inventory-To-Waft mannequin off by $130k, Bitcoin trades under model since 2021

Comparative devices outperform S2F in predicting Bitcoin's tag movements this cycle.

Duvet art/illustration through CryptoSlate. Image comprises blended recount material that can maybe well embody AI-generated recount material.

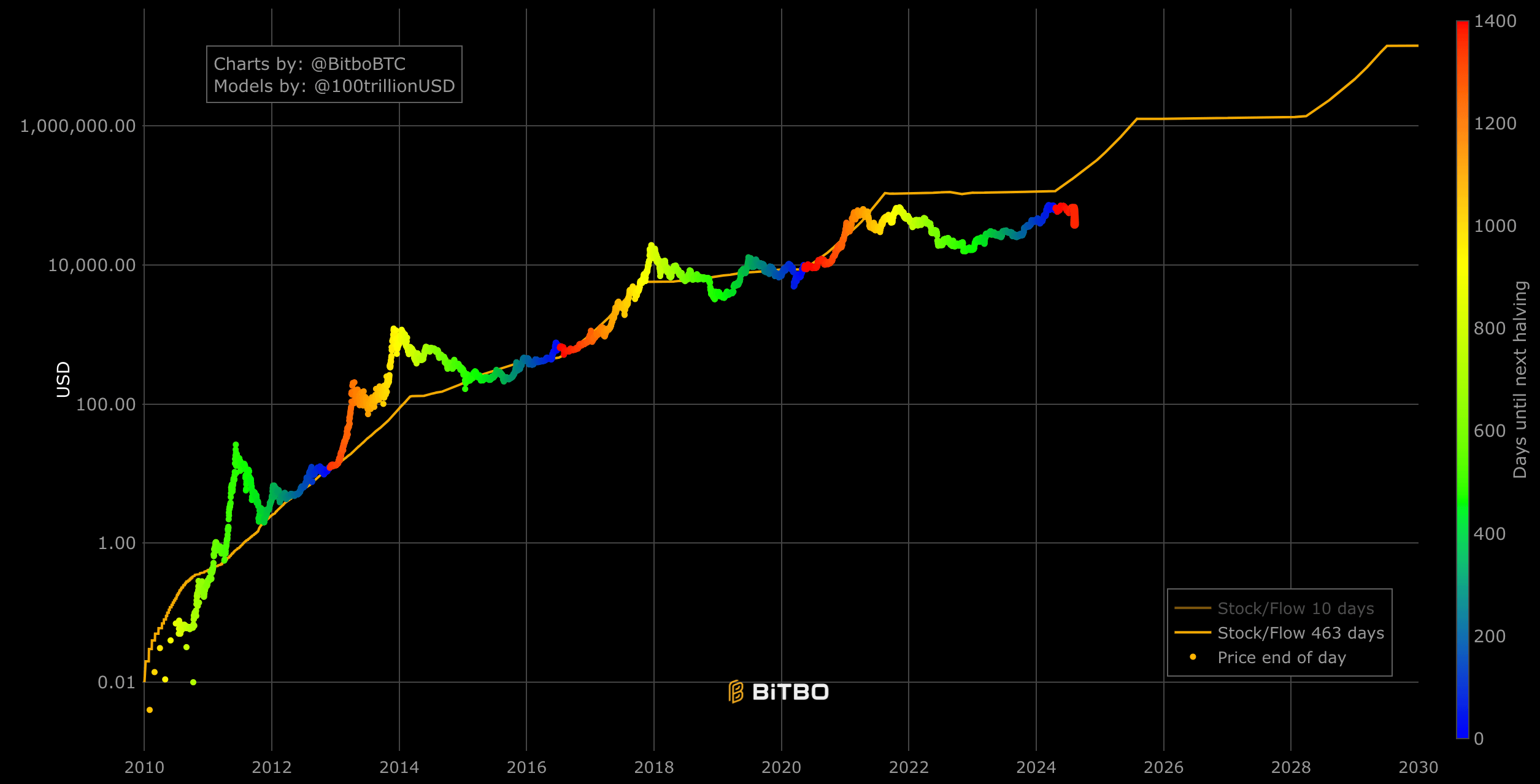

PlanB’s Inventory-to-Waft (S2F) mannequin, identified for predicting Bitcoin’s tag basically based on shortage, has faced scrutiny because the digital asset’s worth has remained under the mannequin’s expectations since 2021. The S2F mannequin, which correlates the increasing shortage of Bitcoin resulting from halving occasions with tag appreciation, urged a critically greater tag than the true market worth at some point soon of the final few years. As of most modern recordsdata, the discrepancy has reached roughly $130,000, elevating questions regarding the mannequin’s reliability in the face of unpredictable market stipulations. The mannequin predicts a tag of around $180,000 presently, whereas Bitcoin remains lawful above $50,000.

The S2F mannequin operates on the theorem that because the breeze with the glide of most modern bitcoins decreases, the present inventory becomes more precious, thus driving up the price. Until 2021, this mannequin historically aligned neatly with important tag movements, critically around halving occasions. On the other hand, the sustained divergence noticed since 2021 signifies a smash from this pattern.

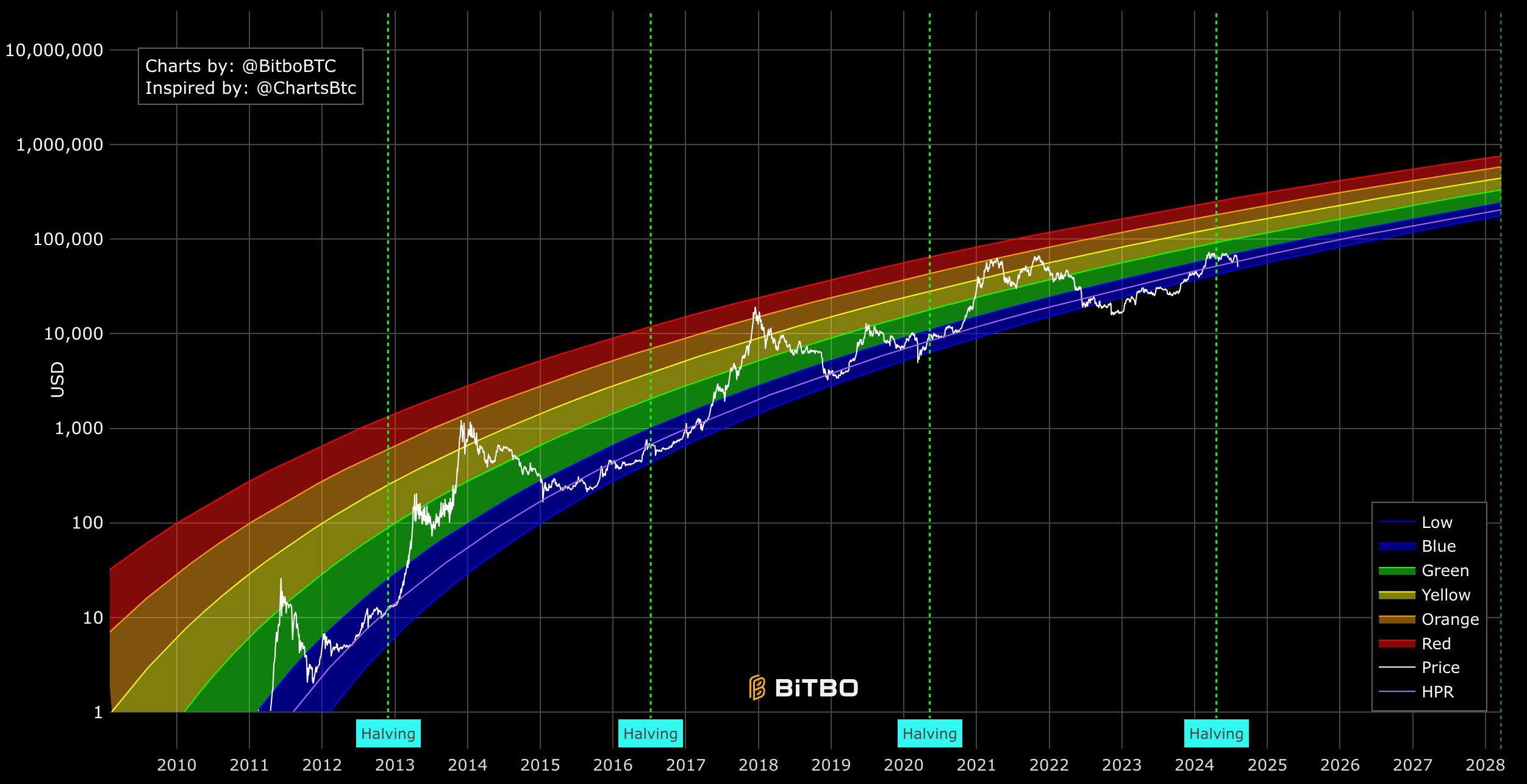

In distinction to the S2F mannequin, varied analytical tools, such because the Rainbow Designate Chart and Energy Regulation Mannequin, consider equipped varied perspectives on Bitcoin’s valuation. The Rainbow Chart, which categorizes tag ranges by market sentiment bands starting from “Low” to “High,” has depicted Bitcoin basically buying and selling internal moderate bands since 2022. This skill a interval of stable growth with out reaching speculative peaks, which the S2F mannequin could consider puffed up. Bitcoin is entertaining in the direction of the lower rush of the rainbow chart, which it broke all the strategy in which through 2022 and 2023. At $50,000, Bitcoin is $220,000 under its greater limit.

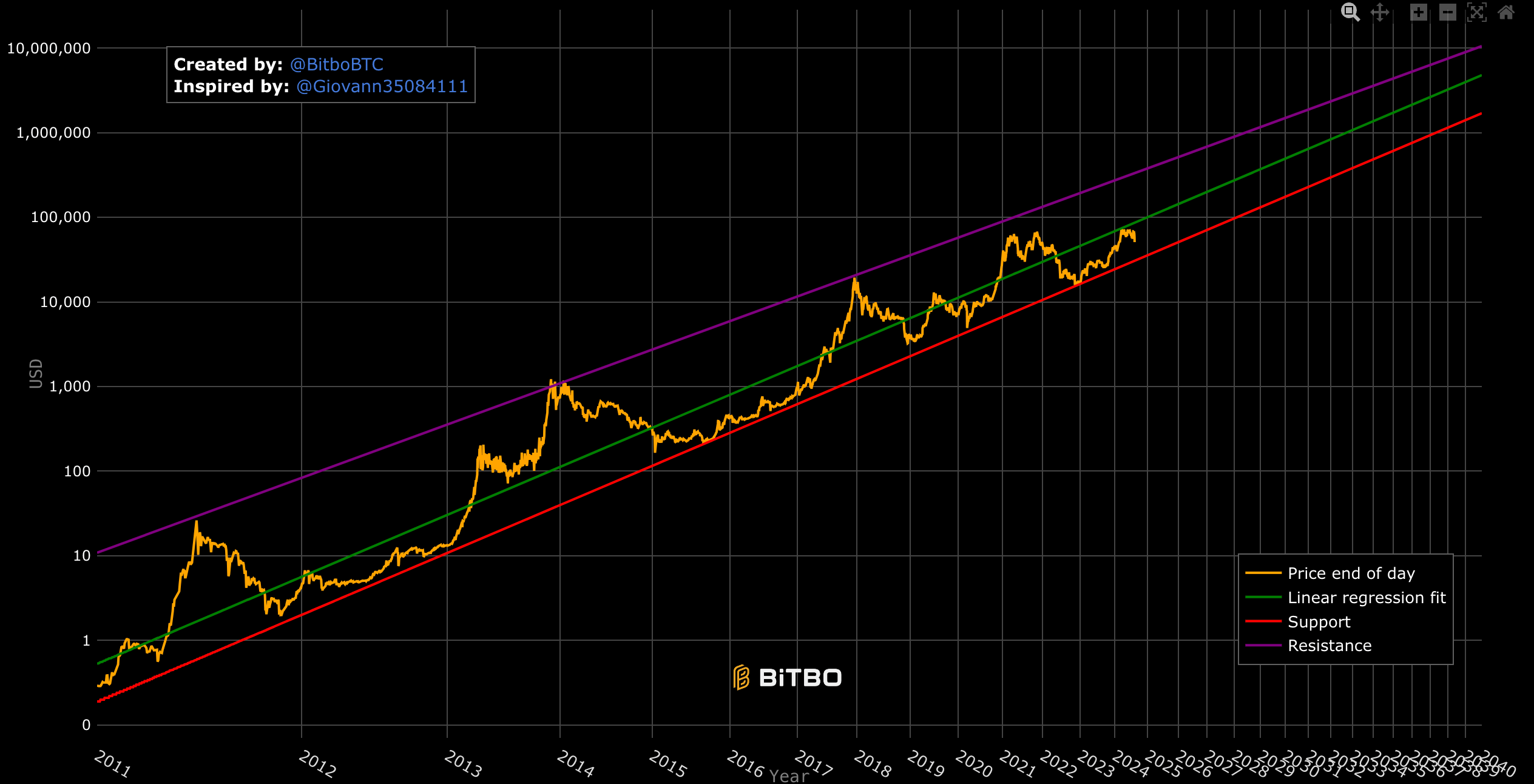

The energy rules mannequin is a statistical mannequin that describes relationships between portions where one quantity varies as a energy of but any other. The Bitcoin energy rules mannequin refers again to the connection between the price and time. It tasks a lengthy-term tag channel with defined enhance and resistance ranges. Bitcoin’s most modern tag movements consider adhered more closely to this mannequin’s projections, declaring an upward trajectory internal the channel but most steadily encountering greater-diploma resistance.

In step with the energy rules mannequin, Bitcoin is peaceable neatly internal fashioned limits and lawful $40,000 under the regression match or very most attention-grabbing tag.

These discrepancies highlight the complexity of predicting Bitcoin’s tag. While the S2F mannequin has been a most popular framework for waiting for market trends, its perceived shortcomings counsel that it might perchance maybe well presumably furthermore fair no longer completely chronicle for the many and dynamic components influencing Bitcoin’s worth. The deviation of as much as $130,000 from the mannequin’s forecast illustrates the need for a more nuanced thought of market forces, along with the affect of investor sentiment, technological developments, and broader economic stipulations. Extra, the energy rules, which also appears to be like in nature and varied man-made phenomena, appears to be like to align more closely with Bitcoin, a currency correlated straight to its energy utilization.

Talked about listed right here

Source credit : cryptoslate.com