Crypto projects lose $278 million to July hacks, second-highest in 2024

Crypto projects lose $278 million to July hacks, 2nd-perfect in 2024

Crypto projects lose $278 million to July hacks, 2nd-perfect in 2024 Crypto projects lose $278 million to July hacks, 2nd-perfect in 2024

CertiK stated that $7.8 million of the stolen sources had been recovered in July.

Conceal art/illustration by device of CryptoSlate. Exclaim entails mixed divulge that would come with AI-generated divulge.

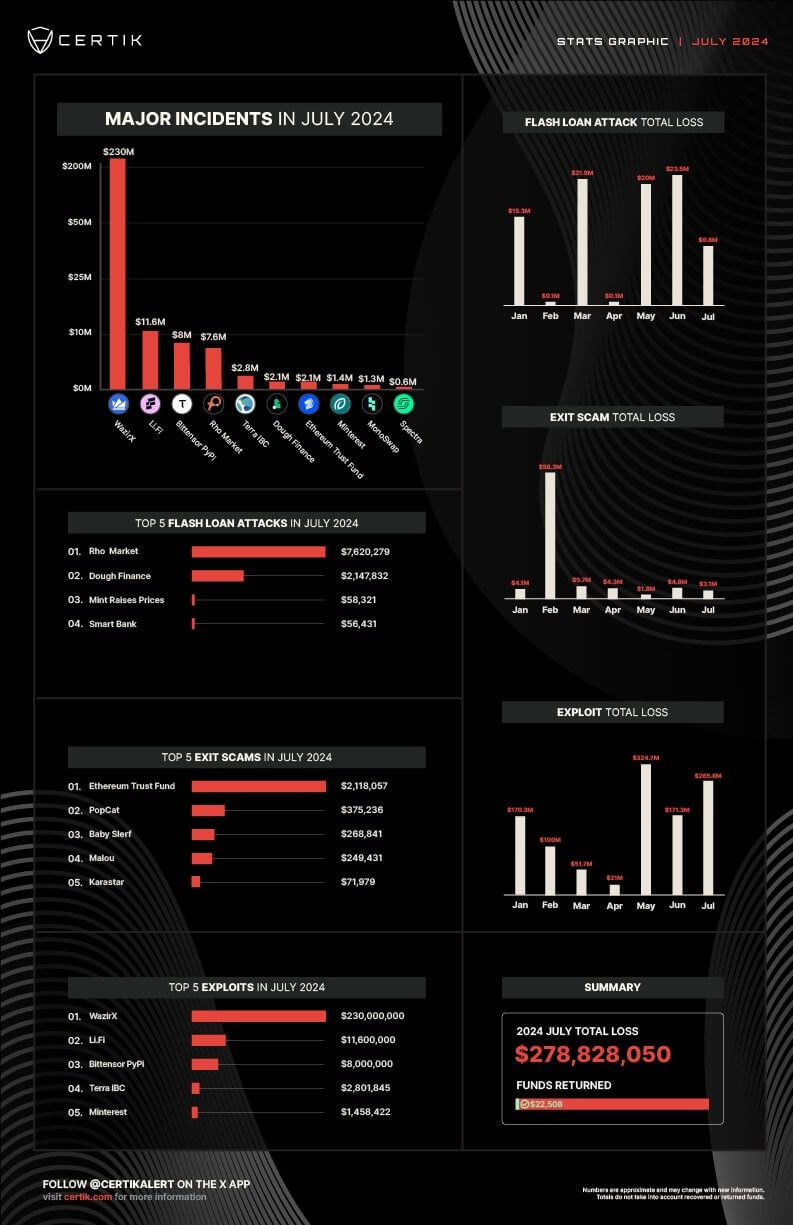

Crypto projects misplaced $278.8 million to exploits and hacks in Julyâthe 2nd-perfect monthly loss this yearâin accordance to blockchain security agency CertiK.

CertiK identified that the losses had been primarily due to exit scams, flash loans, and completely different exploits. On the other hand, $7.8 million of these stolen sources had been recovered, lowering the fetch loss to $270.9 million.

The exploits

Mission exploits had been an essential contributors, amounting to approximately $265 million. The end five exploits, at the side of incidents involving WazirX, Li.Fi, Bittensor PyPi, and Terra IBCÂ had been accountable for roughly $253 million.

On July 18, Indian crypto commerce WazirX suffered an exploit totaling $235 million, triggered by suspicious transactions in its Ethereum network multi-sig wallet. Market observers stated the attack used to be linked to North Korea-backed Lazarus Neighborhood, which has begun laundering the funds by device of crypto mixing instruments esteem Tornado Cash.

In the period in-between, the commerce has paused operations and supplied a $23 million bounty to incentivize the attackers to refund the stolen funds. WazirX has additionally proposed “enforcing a socialized loss device to distribute the impact equitably amongst all users.”

Every other predominant exploit last month used to be the $10 million shining contract exploit of the LiFi protocol. Reviews printed that the platform had suffered the same attack in March 2022.

Flash loan assaults additionally seen considerable incidents. On July 19, Rho Markets, a lending protocol on the Scroll layer-2 network, skilled a $7.6 million exploit on its USDC and USDT swimming pools. The platform later confirmed that the entire quantity used to be recovered from the MEV address.

Dough Finance, a liquidity supplier, suffered a $2.1 million loss by various flash loan transactions. Whereas some funds had been returned, a gigantic fragment used to be sent to the crypto-mixing instrument Tornado Cash.

Furthermore, exit scams contributed roughly $3 million in losses last month.

Mentioned in this text

Source credit : cryptoslate.com