Ethereum price approaches $3k amidst spot ETF anticipation, Dencun upgrade

The price of Ethereum (ETH) approached $3,000 on Feb. 19 amidst anticipation touching on developments which can possibly well be anticipated to happen in the upcoming months.

As of 8:35 pm UTC, ETH became once priced at $2,937 with a market capitalization of $352.96 billion. That substitute represents 4.12% development over 24 hours — considerably higher than Bitcoin’s 0.4% beneficial properties over the same period and moreover higher than the crypto market’s total 1.2% beneficial properties.

Lido Staked Ether (STETH) saw similar beneficial properties of 3.88% over 24 hours. Ethereum 2.0 staking tokens as a class saw beneficial properties of 5.4%, basically basically based fully on records from CoinGecko.

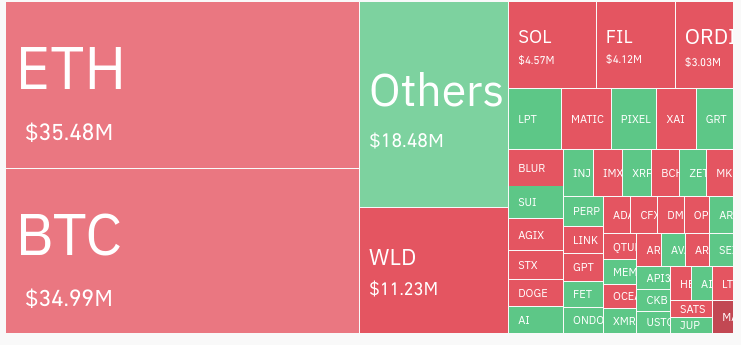

Ethereum became once accountable for a rather little portion of 24-hour liquidations. The asset accounted for $35.forty eight million of liquidations, in conjunction with $8.43 million in prolonged liquidations and $27.05 in instant liquidations.

Enlighten will most certainly be which potential that of ETF anticipation, Dencun toughen

Ethereum’s most up-to-date beneficial properties will most certainly be connected to the likelihood that the US Securities and Swap Price (SEC) will approve an enviornment Ethereum substitute-traded fund (ETF).

Though no predominant regulatory developments around space Ethereum ETFs came about today, a relevant file from the brokerage firm Bernstein bought accepted protection. Analysts at the firm predicted a 50% likelihood that an enviornment Ethereum ETF will most certainly be accredited by May possibly possibly possibly and a advance-determined likelihood that this kind of fund will most certainly be accredited interior 300 and sixty five days. Blended with varied identical predictions in past months, this file might possibly possibly need affected investor sentiment and market process.

Some backlash has moreover emerged around Ethereum’s ETF prospects. Apollo co-founder Thomas Fahrer suggested that Coinbase’s leading role as an ETF custodian might possibly well compromise Ethereum’s proof-of-stake mannequin by allowing the firm to “protect watch over the total network.”

Records from Dune Analytics means that Coinbase is in the meantime accountable for approximately 15% of all ETH staking, whereas any other staking platform, Lido, is accountable for more than 31%. As a result of it is miles unknown how worthy crypto might possibly well be held in space ETH ETFs, it is miles unclear whether Coinbase might possibly well develop dominance by retaining funds on behalf of these ETFs. Furthermore, it is miles unclear whether the SEC will enable staking of ETH held in space Ethereum ETFs, even supposing some applicants unbiased to develop so.

Except for these ETF prospects, there is moreover predominant anticipation around Ethereum’s Dencun toughen, which is determined to happen on March 13. That toughen will severely embrace proto-danksharding, a feature anticipated to toughen ETH transaction costs and scalability.

Ethereum Market Records

At the time of press 10:39 pm UTC on Feb. 19, 2024, Ethereum is ranked #2 by market cap and the attach is up 2.69% over the final 24 hours. Ethereum has a market capitalization of $356.82 billion with a 24-hour trading volume of $15.44 billion. Be taught more about Ethereum ›

Ethereum

10:39 pm UTC on Feb. 19, 2024

$2,969.40

2.69%

Crypto Market Summary

At the time of press 10:39 pm UTC on Feb. 19, 2024, the total crypto market is valued at at $1.ninety nine trillion with a 24-hour volume of $68.83 billion. Bitcoin dominance is in the meantime at 51.35%. Be taught more relating to the crypto market ›

Source credit : cryptoslate.com