Ethereum ETFs pre-market trading begins, all set for official debut at market open

Ethereum ETFs pre-market procuring and selling begins, all inform for legit debut at market start

Ethereum ETFs pre-market procuring and selling begins, all inform for legit debut at market start Ethereum ETFs pre-market procuring and selling begins, all inform for legit debut at market start

Pre-market procuring and selling has considered modest designate efficiency for Ethereum.

Duvet art/illustration by technique of CryptoSlate. Checklist includes mixed philosophize which also can just consist of AI-generated philosophize.

The US Securities and Replace Price has issued notices of effectiveness for several Ethereum-linked swap-traded funds (ETFs) as they inaugurate procuring and selling this day, July 23.

Available files on the regulator’s online net page confirms the effectiveness of the S-1 submitting of assorted issuers, at the side of VanEck, Grayscale, Bitwise, Invesco, and Constancy, among others.

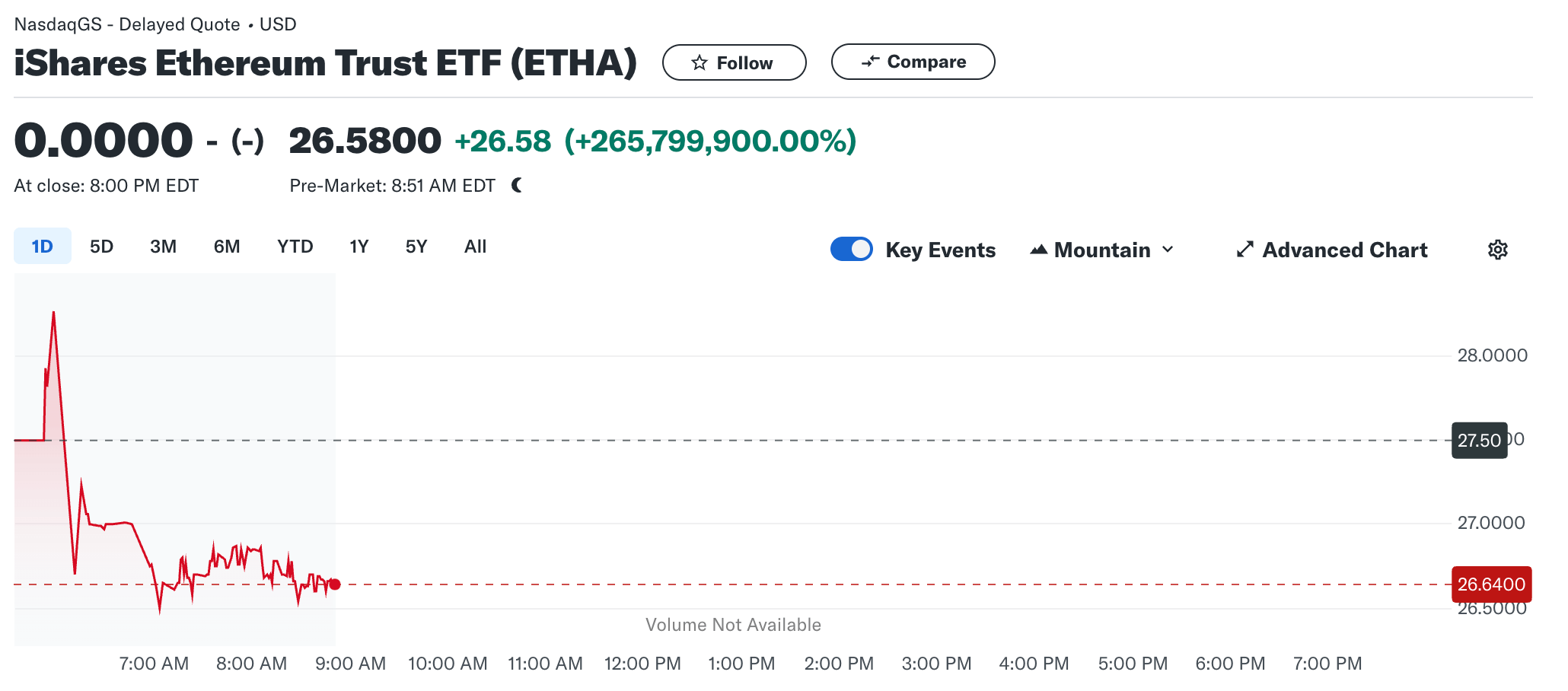

Pre-market procuring and selling is already start, with BlackRock’s iShares Ethereum Have confidence (ETHA) opening at $27.50 before falling a exiguous bit to $26.64 as of press time.

On July 22, reports emerged that the SEC had given its final approval for the discipline Ethereum ETFs to start procuring and selling on July 23. Asset management firm Grayscale confirmed that its Ethereum ETF productsâthe Grayscale Ethereum Mini Have confidence and Ethereum Have confidence Fundâwould start procuring and selling on the Recent York Stock Replace this day.

This sing ends weeks of awaiting ETF merchandise of the second-finest digital asset by market capitalization, which the regulator had broadly investigated and first and predominant advised used to be a security.

Market experts hailed the switch, declaring that the ETFs will provide convenient rep entry to, liquidity, and transparency for traders taking a glance to procedure exposure to digital sources. Jay Jacobs, BlackRock’s US Head of Thematic and Inviting ETFs, mentioned:

“Ethereumâs enchantment lies in its decentralized nature and its doable to pressure digital transformation in finance and varied industries.”

How will ETH designate react?

Whereas ETH’s designate has been largely muted despite the upcoming launch of the ETFs, blockchain compare firm Kaiko reported that it used to be unclear how the preliminary inflows from the merchandise might maybe well well impact the asset.

Will Cai, head of indices at Kaiko, mentioned:

“The launch of the futures essentially based completely mostly ETH ETFs in the US late closing 365 days used to be met with underwhelming effect an impart to, all eyes are on the discipline ETFsâ launch with excessive hopes on hastily asset accumulation. Even supposing a rotund effect an impart to report also can just now no longer emerge for several months, ETH designate will be sensitive to influx numbers of essentially the most crucial days.”

Within the intervening time, Bitwise’s CIO Matt Hougan predicted that the upcoming discipline Ethereum ETFs will propel the digital asset’s designate to original all-time highs of larger than $5,000. He mentioned:

“By 365 days-conclude, Iâm assured the original highs will be in. And if flows are stronger than many market commentators inquire, the associated price will be powerful larger still.”

Mentioned listed right here

Source credit : cryptoslate.com