Ethereum braces for spot ETF boost as 40% of supply remains locked

Ethereum braces for set aside ETF boost as 40% of offer stays locked

Ethereum braces for set aside ETF boost as 40% of offer stays locked Ethereum braces for set aside ETF boost as 40% of offer stays locked

Market eyes Ethereum surge with 40% offer locked amid ETF buzz.

Duvet art/illustration by technique of CryptoSlate. Image entails mixed narrate that also can encompass AI-generated narrate.

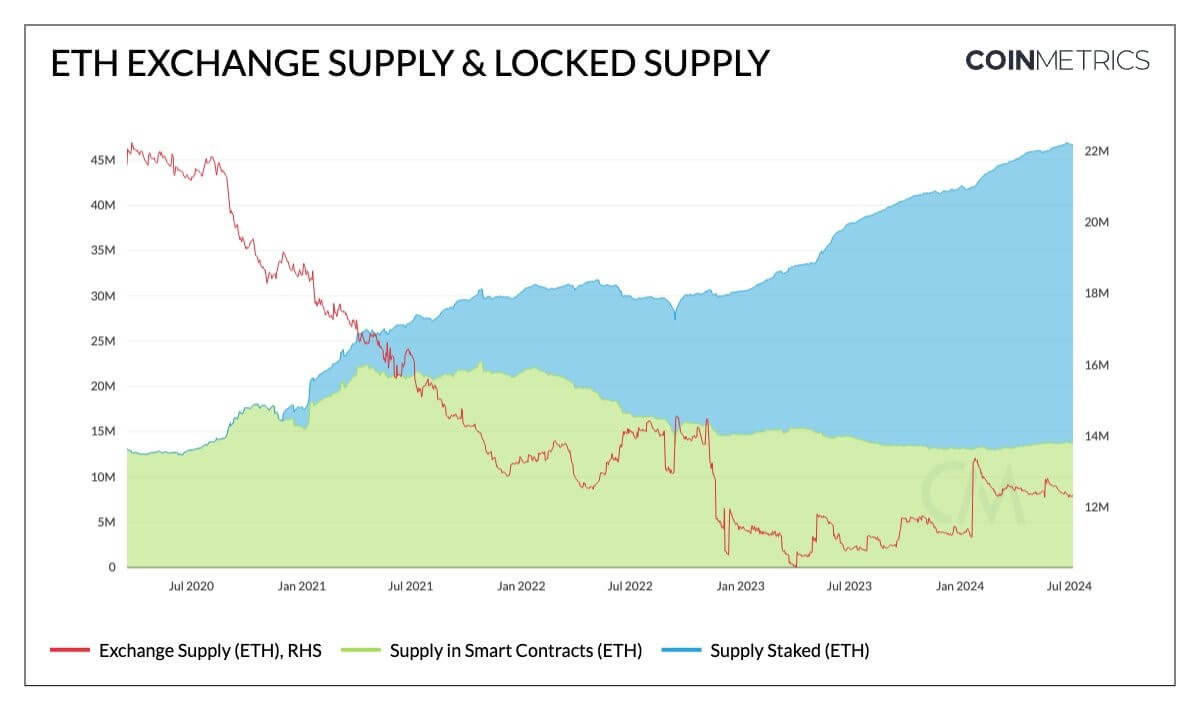

Roughly 40% of Ethereum offer is locked as the market anticipates the final recognition of ETH set aside-primarily primarily based alternate-traded funds (ETFs).

A breakdown of this “locked offer” shows that over 33 million ETH is staked on the community, representing around 28% of Ethereum’s total offer, in line with Dune Analytics files.

Proof-of-stake networks like Ethereum require users to “lock up” their digital resources to lend a hand its security and operations, and in return, they make rewards.

Additionally, 12% of the offer is locked in neat contracts and bridges, which is at risk of be seeing excessive adoption lately. As an illustration, A.J. Warner, Chief Approach Officer at Offchain Labs, infamous that ETH within the Arbitrum One bridge has constantly elevated over the past three years.

Market observers think this gigantic ETH lockup and the upcoming ETF approval will boost ETH prices. Tom Dunleavy, Managing Partner at MV Capital, identified that the approval of set aside Ether ETFs will tremendously affect the market. He mentioned:

“The set aside ETH ETF flows are going to abruptly transfer this market.”

ETF approval

Meanwhile, anticipation continues to develop surrounding the final approvals for a suite Ethereum ETF within the US.

On July 9, Bitwise’s Chief Commercial Officer, Katherine Dowling, acknowledged the ETFs are nearing approval, declaring that the Securities and Commerce Rate (SEC) became once addressing most effective about a final points.

Dowling suggested the products might well presumably perchance be current over the summer time, a sentiment echoed by Bloomberg ETF analyst James Seyffart.

Seyffart speculated that approval also can obtain the pause of the month despite his low self belief in staunch inaugurate date predictions. He acknowledged:

“I possess quite low self belief in these inaugurate date predictions at this level. There’s no deadline & SEC’s Corp Fin is taking its time right here (I don’t blame them). But these adjustments were very minimal and [i don’t know] why the ETFs wouldn’t be prepared to transfer inner a few weeks.”

Meanwhile, crypto bettors on Polymarket seek files from the products to inaugurate sooner than the pause of the month, with an 87% likelihood of being listed for trading by July 26.

Talked about listed right here

Source credit : cryptoslate.com