How institutional networks are preparing for Bitcoin integration

How institutional networks are preparing for Bitcoin integration

How institutional networks are preparing for Bitcoin integration How institutional networks are preparing for Bitcoin integration

Bitcoin ETFs surpass gold, making waves in institutional investment and sparking innovations in community scalability and sustainability.

Quilt art/illustration through CryptoSlate. Image entails combined scream material that may per chance per chance also encompass AI-generated scream material.

The following is a guest submit from Shane Neagle, Editor In Chief from The Tokenist.

Half a three hundred and sixty five days after Bitcoin ETFs launched, it's miles safe to claim that they've been the most winning ETF open in history, having generated a $309.fifty three billion quantity. Ethical within the first day of trading, location-traded Bitcoin ETFs pulled in $4 billion, crushing the outdated file holder, Gold ETF (GLD), which took 3 days to top $1 billion in inflows.

Right here's your total extra impressive as Bitcoin is a new asset in comparison with used gold. The vogue clearly points to Bitcoin being extra match for aim in the digital age. But what is that aim?

BlackRockâs Head of Thematic & Moving ETFs, Jay Jacobs, currently famed that Bitcoin is a âdoable hedge against geopolitical and financial risks”. By now, most folk are aware that central banksâ capability to tamper with the money supply brings many perfect hazards, from file-breaking budgetary deficits to inflation as an additional layer of taxation to conceal these wild spending sprees.

Gold is much less suited to counter that capability because it's miles bodily, confiscatable, and not in actuality restricted. Because Bitcoin is one-tenth the dimension of the gold market, its designate is extra dangerous, nonetheless it's miles mostly a extra beautiful good points machine.

Now that Bitcoin ETFs hang simplified and institutionalized entry to extra thrilling digital gold, which steps are desired to accomplish sure that that vogue continues?

Making sure Network Reliability

Owing to its proof-of-work (PoW) consensus mechanism, Bitcoin is twin-natured. It is miles a digital asset anchored into the bodily truth of energy and hardware. This underlying foundation affords Bitcoin its designate as a decentralized counter to central banking.

In flip, the parts of that foundation, the Bitcoin community, hang to scale as a lot as proceed the institutional consumption. On the moment, the Bitcoin community handles spherical 412k transactions per day, virtually double from two years previously. Even even supposing the median transaction rate oscillates reckoning on community load, it rarely exceeds $5 per transaction.

In parallel, their networks hang to scale to accomplish sure that the Bitcoin community handles orders of magnitude increased load coming from institutions. To amplify their balance and robustness, they hang to take care of multiple community parts, from tool and servers to hardware and web connection.

Scalable Blockchain Solutions

Ethical as IBM made essential contributions to developing fresh huge language items (LLM), the legacy computer company also made a ambitious case for blockchain scaling with IBM Blockchain. This immutable ledger is basically based totally mostly on an open-source Hyperledger Cloth framework with a total role of instruments for constructing blockchain platforms.

The kind of framework may per chance per chance also interface with the Bitcoin ecosystem through atomic swaps, similar to digital vaults with timed orderly contracts. In an identical blueprint, Visa proposed an experimental Neatly-liked Price Channel (UPC) framework as a hub for blockchain community interoperability. World banking community SWIFT had already done the 2d take a look at piece for atomic settlement functionality.

Zooming out, a declare emerges of enterprise-grade blockchain solutions for institutions, interlinking with global hubs and intermediating with institutions that handle exposure to Bitcoin, similar to Coinbase.

Actual Servers

Powering scalable blockchain solutions is available in the make of hardware. These can either be inner servers, through customized solutions equipped by Broadcom, or offloaded to exterior choices just like the Canton Network.

As a decentralized infrastructure, the Canton Network is a community of networks, constructing on Daml orderly contract language and micro-products and services structure. The latter lets in for every service plugged in to to hang its hang server, expandable with extra CPUs and storage.

Using atomic settlements, the Canton Network makes steady-time settlement doubtless all the blueprint by varied blockchain apps. By outsourcing products and services to such networks, companies and institutions can focal level on core aspects barely than IT infrastructure management, including the maintenance of CPUs, dedicated GPU web web hosting to diversify into AI give a boost to, and other predominant hardware.

Web Connectivity

Nodes in any blockchain community hang to talk repeatedly to validate transactions and attain settlements by adding them as the following block on the blockchain ledger. In other phrases, web connectivity necessarily entails redundancy and failover solutions.

As an illustration, when Solana experienced community downtime issues, co-founder Anatoly Yakovenko employed Soar Crypto to rupture Firedancer as a secondary community validator client to fortify community throughput and balance.

With broader solutions just like the Canton Network, taking part in give a boost to from the Huge Tech and Huge Bank, redundancies, multi-channels, backup systems, and cargo balancing are already baked into the DLT cake.

Enhancing Network Performance

It is miles inherent in all forms of computer networks to endure from some level of packet loss and jitter. Packet losses can happen attributable to overwhelming put a question to, inflicting congestion, community interference, depraved tool or hardware, and recordsdata corruption on exhausting drives.

Transmission Management Protocols (TCP) address packet losses by retransmitting recordsdata, which causes delays, or by Forward Error Correction (FEC), which provides redundant recordsdata to packets, casting off the need for retransmission. The Bitcoin Relay Network uses FEC to this succeed in, as does the Blockstream Satellite community, as a substitute avenue to receive Bitcoin blockchain recordsdata.

As for jitter, sure recordsdata packets can reach at varied intervals. When this jitter occurs, packets land in varied orders, disrupting recordsdata trip. The jitter challenge is mostly dealt with with buffers that rapid store streamed packets to accomplish sure that their perfect-searching expose arrival.

One other reach to handle jitter is to introduce quality of service (QoS) community configurations that prioritize serious web scream online visitors. This may well per chance per chance also be applied to decrease packet loss. Network create itself is a mountainous factor in lowering jitter by guaranteeing the community has as few hops as doubtless.

The Bitcoin community advantages from its decentralized create because every transaction requires multiple confirmations. If jitter occurs, later confirmations offset the delays. Most importantly, the Bitcoin mainnet has an auto-adjusting challenge mechanism that maintains the common block time at 10 minutes.

In discover, the management of the community’s recordsdata packet loss and jitter lands on on-plot vs. ISP solutions.

On-plot vs. ISP Solutions

On-plot solutions require organizations to handle their IT infrastructure. While this affords institutions total management, including regulatory recordsdata compliance and sooner personnel response, the upfront prices for hardware and storage are significantly increased.

On the opposite hand, ISP-hosted solutions are more straightforward to scale as with out a doubt expert companies are doubtless to be successfully-oiled machines, handling every upkeep and community uptime. On the clientsâ rupture, this requires a respectable web connection and the choice of the most attention-grabbing packet loss and jitter metrics.

Case in level, Amazon Web Products and services (AWS) affords purchasers a World Accelerator instrument to give a boost to and balance community efficiency. Alongside Amazon Managed Blockchain and Quantum Ledger Database (QLDB), such products and services propelled AWS to change into one in every of the infrastructure pillars of the blockchain role.

As for ISPs themselves, they're most often much less imminent on their jitter/packet loss metrics, as they rely on several components. To that rupture, there are hundreds instruments to discover community latency, packet loss and jitter, similar to PingPlotter.

Jack Dorsey’s Block (outmoded Square) opted to kind its hang Bitcoin mining community, utilizing its 3 nm chip create, doubtless constructed by TSMC foundries. With an in-house, open-source mining hashboard, which is like minded with Raspberry Pi controllers, Block is heading to role up new requirements for the Bitcoin ecosystem.

The other share of the Bitcoin scalability puzzle revolves spherical energy.

Sustainable Vitality Solutions

It is miles mostly mentioned that Bitcoin is digital energy, or higher but, tokenized energy. In the rupture, Bitcoin’s proof-of-work items it aside from hundreds of copypasta cryptocurrencies, making it virtually unassailable from a community security standpoint. And that consensus algorithm exerts energy, as expected from any work.

But how considerable and what roughly energy? Bitcoinâs energy expenditure is mostly in comparison with a nationâs footprint, similar to the Netherlands or Argentina. It is miles sufficiently high for Greenpeace to call for a campaign to substitute Bitcoin from proof-of-work to proof-of-stake.

BRÃKING: @greenpeaceusa continues its SEXIST anti-#Bitcoin campaign, releasing new video about âBitcoin BROS.â

NEWSFLASH to Greenpeace misogynists: there are WOMEN in Bitcoin, & Bitcoiners will not stand by whereas you ERASE them.

Please retweet ought to you suspect Greenpeace is sexist. pic.twitter.com/qX3emR8TaL

â Walkerâ¡ï¸ (@WalkerAmerica) June 22, 2024

Yet Greenpeace itself may per chance per chance also open this form of shift, on condition that Bitcoin’s open-source code is on hand to all. The challenge is that with out a community and market hobby, this form of tweak may well be meaningless.

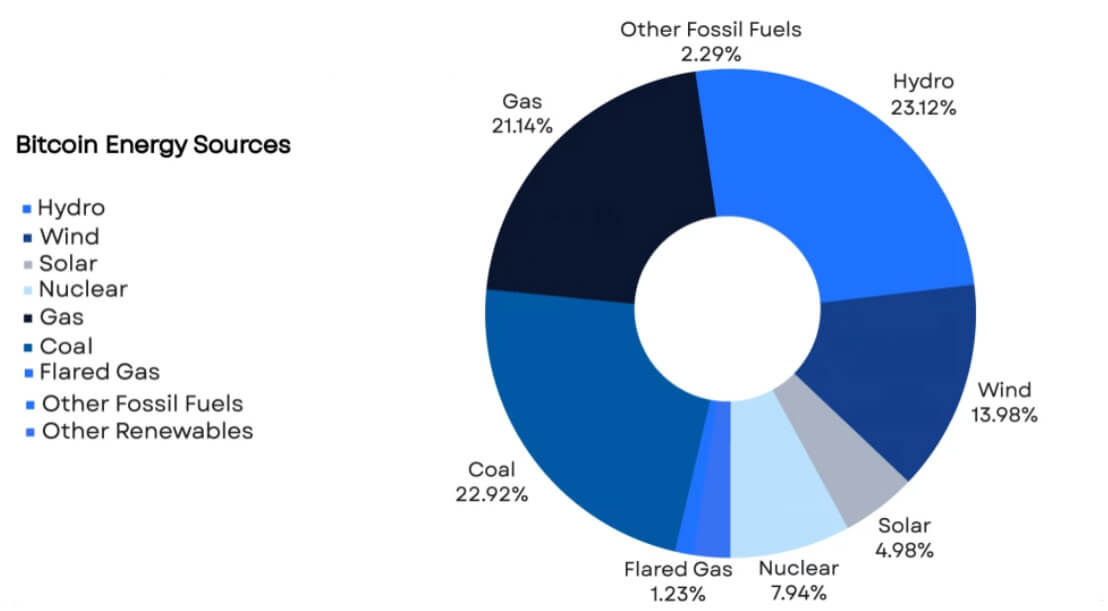

For the time being, over 50% of the Bitcoin community draws vitality from renewable sources. In line with Daniel Batten’s examine through Batcoinz, most of it comes from hydro, wind, photo voltaic, and nuclear.

No longer simplest did Bitcoin step onto the majority-inexperienced territory, nonetheless it has been acknowledged as a key ingredient in balancing vitality networks. Namely, the Electrical Reliability Council of Texas (ERCOT) can pay huge Bitcoin mining companies, similar to Bitdeer and Revolt Platforms, to stabilize the grid all over anomalous conditions similar to heat waves.

As currently as June thirteenth, ERCOT rapid that Bitcoin mining be at as soon as integrated as a Controllable Load Handy resource (CLR) to boost vitality grid balancing. Moreover, there is an increasing vogue for Bitcoin miners to use flared gasoline from oil drilling operations. In another case wasted and burned off, this byproduct can even be captured to vitality Bitcoin mining rigs.

Now that BlackRock, the main driver of the ESG framework, is pushing Bitcoin, that is a transparent signal to institutional traders that the âdirty Bitcoinâ myth is a bygone utter.

Block has but to worth its 100% photo voltaic-powered mining facility in West Texas. On the opposite hand, multiple Bitcoin mining companies, similar to Bitfarms, Iris Vitality, TeraWulf, and CleanSpark, hang already transitioned to shut to-zero carbon footprints.

With nuclear vitality on the horizon attributable to AI recordsdata heart requires, traders may per chance per chance also soundless rely on even increased greening of Bitcoin operations. And in the chance of Donald Trumpâs victory in the following presidential elections, Bitcoin sustainability issues will additional go away.

Conclusion

In 2022, Messari famed that gold mining produces three instances as many carbon emissions as Bitcoin. Since then, Bitcoin has outperformed gold ETF capital inflows by an even increased magnitude.

It turns out that there is huge designate to be came all the blueprint by in an asset that may per chance per chance't be tampered with on a purposeful level and is just not managed by any individual. Moderately, Bitcoin is enforced by ingenious cryptography, tethering code to hardware assets and energy.

With capital rattling broken, and entry to Bitcoin exposure put on the same level as another stock, it's miles a urge to new highs and new lows to aquire the dip. Building from the skills of alternative blockchain networks and mining companies, the tech is at as soon as on hand to faucet into this rising ecosystem.

Source credit : cryptoslate.com