Russian official says international CBDC payments will be the norm within 5 years

Russian reputable says international CBDC funds might possibly be the norm within 5 years

Russian reputable says international CBDC funds might possibly be the norm within 5 years Russian reputable says international CBDC funds might possibly be the norm within 5 years

Aksakov also printed that Russia might possibly launch using the digital ruble for international transactions as soon because the 2nd half of of 2025.

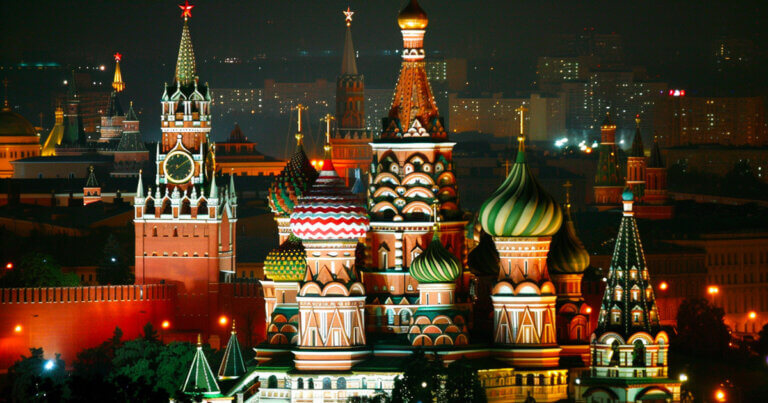

Duvet art/illustration by skill of CryptoSlate. Image comprises blended suppose that would consist of AI-generated suppose.

Central bank digital currencies (CBDCs) are anticipated to turn out to be trendy and must aloof be old for international funds as a norm within the next 5 years, per Anatoly Aksakov, Chairman of the Russian Notify Duma’s Financial Markets Committee.

Aksakov made the remarks at some level of an interview at the St. Petersburg World Economic Dialogue board (SPIEF). He infamous that currently, few countries maintain made valuable traits in imposing national digital currencies.

In accordance with the Russian MP, this technological run map countries are no longer yet ready to make use of digital currencies for international transactions. Alternatively, he expressed self perception that within 5 years, this also can turn out to be regular follow.

Home funds by H2 2025

Aksakov printed that Russia might possibly launch using the digital ruble for international transactions as soon because the 2nd half of of 2025. Alternatively, he also emphasised the necessity to first test the digital ruble domestically.

He added that wider implementation within the nation, in conjunction with use by lawful entities, is needed before increasing its use internationally. He also instant testing budget financing with perfect contracts as soon as imaginable.

Russia has been at the forefront of CBDC constructing, with the Central Bank of Russia actively engaged on the digital ruble. The idea of the digital ruble emerged as share of a broader effort to modernize the nation’s financial diagram and reduce again dependency on old banking infrastructure.

In October 2020, the Central Bank of Russia released a consultation paper outlining the aptitude advantages and dangers of introducing a digital ruble. Since then, Russia has been testing different aspects of the CBDC in pilot applications.

Traditionally, Russia has pursued better financial independence, particularly basically based on Western sanctions. The introduction of the digital ruble aligns with these efforts, aiming to facilitate extra true and atmosphere pleasant financial transactions, bypassing old financial systems that can maybe possibly be area to international pressures.

This strategic sail also targets to enhance Russiaâs financial sovereignty and reduce again the affect of foreign sanctions on its financial diagram.

World testing partners

Aksakov also printed that the preliminary testing for international transactions in CBDCs might possibly involve China or Belarus.

He stated that China has made valuable progress with the digital yuan, and each and each Russia and China maintain trip in the skills, making it possible to launch settling transactions by skill of digital currencies.

He added that the 2 countries are “technologically end,” which can maybe possibly streamline the testing direction of. Meanwhile, Belarus most incessantly is a ability accomplice as a consequence of its pleasant relatives with Russia, Aksakov stated.

Source credit : cryptoslate.com