Aave tops $20 billion in deposits amid record revenue and fee switch discussions

Aave tops $20 billion in deposits amid document revenue and rate switch discussions

Aave tops $20 billion in deposits amid document revenue and rate switch discussions Aave tops $20 billion in deposits amid document revenue and rate switch discussions

Aave's document $115 million annualized revenue has sparked discussions a pair of rate-switch proposal.

Quilt art/illustration by capability of CryptoSlate. Image involves mixed utter that can include AI-generated utter.

Aave team people are pushing for a rate switch proposal after the DeFi protocol’s annualized revenue reached contemporary highs this week.

On June 2, Matthew Graham, a member of the Aave liquidity committee, reported that the protocol used to be “averaging stunning over $80 million in annual revenue from seven Aave v3 & v2 deployments” all over varied blockchain networks, including Ethereum.

Stani Kulechov, the founder of Aave, corroborated this milestone, mentioning:

“Aave DAO is now incomes $115 million annualized. Let that sink in.”

This high revenue is no longer sudden, pondering CryptoSlate fair lately reported that Aave used to be one of many few decentralized functions preferred by crypto customers over veteran blockchain networks.

Which capability that, the spectacular earnings hang reignited team calls for a rate switch proposal. A rate switch lets in a platform to toggle particular user prices on or off, potentially redistributing transaction-generated prices to platform people. Significantly, a entire lot of DeFi protocols, including Uniswap, are contemplating initiating an initiative for their customers.

Meanwhile, these calls attain more than a month after Marc Zeller, founder of the Aave Chain Initiative, suggested that a rate switch proposal used to be in type. Zeller highlighted that the Aave DAO has a mountainous revenue margin, offering a monetary cushion for the subsequent 5 years.

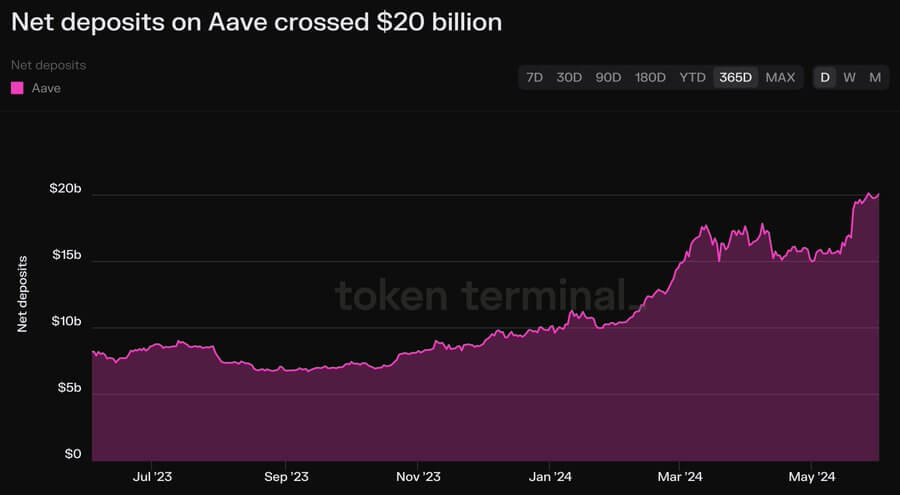

Deposits harmful $20 billion.

Basically based on Token Terminal recordsdata, the amount of crypto deposited in Aave has exceeded $20 billion, a stage no longer seen for the explanation that shatter of Terra’s UST algorithmic stablecoin in 2022.

Market experts acknowledged the protocol’s voice reveals that the DeFi sector used to be with out note convalescing from the lows of the 2022 undergo market that ended in the crumple of a entire lot of centralized lenders cherish Celsius, Genesis, and others. Additionally, they acknowledged the increased liquidity displays the rising investor hobby in Ethereum, driven by the optimism surrounding the ETH change-traded fund (ETF) approvals.

Basically based on DeFillama recordsdata, Aave is the greatest crypto-lending platform within the commerce, primarily according to the Ethereum network. The platform fair lately disclosed plans to introduce a entire lot of key initiatives, including launching Aave V4, a recent visible identity, and expanded DeFi functionalities for its customers.

Talked about listed here

Source credit : cryptoslate.com