Institutional Money Is Flowing Back Into Crypto – Here’s How Margex Copy Trading Helps You to Approach the Markets

Institutional Cash Is Flowing Encourage Into Crypto – Right here’s How Margex Copy Buying and selling Helps You to Formulation the Markets

Institutional Cash Is Flowing Encourage Into Crypto – Right here’s How Margex Copy Buying and selling Helps You to Formulation the Markets Institutional Cash Is Flowing Encourage Into Crypto – Right here’s How Margex Copy Buying and selling Helps You to Formulation the Markets

Leveraging institutional momentum, Margex's redesigned platform empowers outlets with educated alternate replication and zero-rate conversions.

Camouflage art work/illustration by activity of CryptoSlate. Image contains mixed roar material that would also consist of AI-generated roar material.

Disclosure: Right here's a sponsored post. Readers ought to habits extra research forward of taking any actions. Study extra ›

Binance’s $4.3 billion settlement with U.S. regulators became a mountainous shift within the mentality of institutional adoption of digital sources, which has suffered many dismissals from institutional avid gamers who designate digital sources as showy, nugatory sources propelled by criminals.

Step by step, the tectonic plates of tips that shaped the sentiments of these institutional corridors of energy own shifted. For the main time in a protracted time, digital sources take care of Bitcoin (BTC) would be in ideological collision with a trademark of institutional acceptance.

Many innovative tips go into the cryptocurrency space, creating never-ending market alternatives. Binance’s collaboration with Signum, which permits mountainous avid gamers within the cryptocurrency space to withhold their sources in other locations, extra amplifies many revolutions and can enable institutions to explore digital sources.

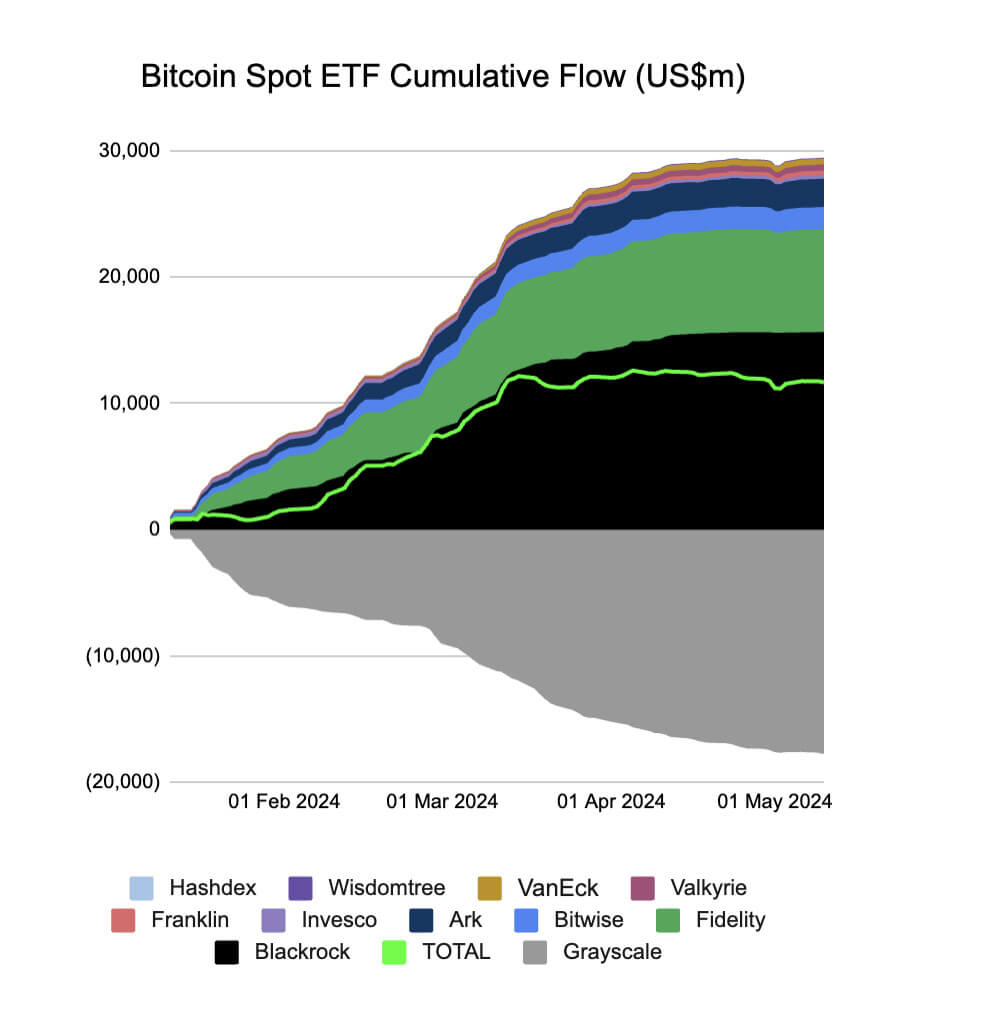

Additionally, institutions own persevered to float into the crypto market after state Bitcoin alternate-traded fund (ETF) approval, allowing many corporations to alternate a proxy with low administration costs and enabling them to take part in assorted solutions take care of hedging.

These factors own pushed mighty consideration and the money float into the crypto space, as this has been enormously seen in Bitcoin’s performance, which has hit new all-time highs. Lustrous money, outlets, families, hedge funds, and corporations own all recently added Bitcoin as a procedure for portfolio diversification.

Analysis has shown that a staggering $17 billion of institutional capital has flooded the cryptocurrency space correct this year alone as institutions proceed to allocate a percentage of their investments to digital sources.

The farside Bitcoin ETF float shows that mountainous avid gamers akin to BlackRock, Constancy, VanEck, and diverse institutional corporations own shown mighty interest in digital sources, with institutional money taking half in a key characteristic within the modern buzz of the cryptocurrency market.

More than seven out of ten institutional investors own shown an eagerness to diversify their investments into digital sources, with bigger than five of these institutional investors taking many actions to comprise these crypto sources.

BlackRock Spearheads Institutional Cash Coming Into Crypto

BlackRock, a number one asset supervisor and one of the worldâs ideal institutional giants, has shown mountainous interest within the cryptocurrency ecosystem, driving mighty innovation into the tokenization of cryptocurrency sources.

These actions from well-respected financial products and companies prove a increasing adoption of blockchain technologies amongst primitive organizations. The unbelievable advantages the blockchain ecosystem presents, akin to transparency, liquidity, and consume cases by assorted projects, are driving this adoption.

Interior most corporations own at the delivery dominated the blockchain ecosystem, however the mass adoption of it by institutions may perhaps well per chance pave the vogue for added operational efficiency. Innovative tips such because the tokenization of digital sources by a crypto startup, Libre, sparked mighty consideration from JPMorgan and BlackRock, shifting their point of interest extra on bringing innovation to this space and tokenizing digital sources.

BlackRockâs CEO, Larry Fink, sees blockchain skills and tokenization of crypto sources as a blueprint to in some unspecified time in the future replicate such mountainous tips on shares and bonds to enact a unified blockchain ledger enabling instantaneous transactions.

Unlocking Institutional Alternatives

Amidst the evolving world of finance, asset tokenization continues to be rampant amongst institutional organizations akin to BlackRock, JPMorgan, Constancy, and others. It targets to be a pivotal power and a extremely promising transformation for these institutions within the advance future.

Novel research from Boston Neighborhood Consulting (BGC) and funding firm ADDX shows a transparent route for many institutional corporations exhibiting extra interest within the cryptocurrency ecosystem as their interest tilts to asset tokenization. Asset tokenization is projected to be a $4 trillion industry because it attracts extra institutions into the gap and can materialize within the subsequent a protracted time.

This shift in asset tokenization by financial institutions is now not speculative when put next to the foreign money market model, because it has been concretely manifested by these market avid gamers, who acknowledge this industry has doable. The centre stage for primitive finance and blockchain skills bridging its hole would be a ball space in motion, as this may perhaps perhaps enable liquidity, efficiency, and better accessibility.

As this offers many alternatives for institutional investors, rising technologies akin to synthetic intelligence (AI), replica trading, social trading, and others had been adopted by many outlets to faucet into the never-ending money flowing into the crypto space by institutional investors.

Margex Copy Buying and selling Helps Outlets Space Greater In The Market

The root of primitive finance getting into the cryptocurrency market became a mirage. Not till recently own many primitive finance institutions shown mighty interest within the crypto space.

Outmoded finance Institutions coming into the cryptocurrency market excite many outlets. Principal new money has been pumped into the market, suggesting the modern market uptrend is a part of their presence. Many outlets would take care of to leverage the modern market sentiment.

Alternate-traded funds (ETFs) and exact-world sources (RWAs) own caught institutions’ consideration. Digital sources beneath this model own exceeded expectations within the previous couple of months, with the Margex platform ensuring that these excessive-conviction sources are on hand for trades.

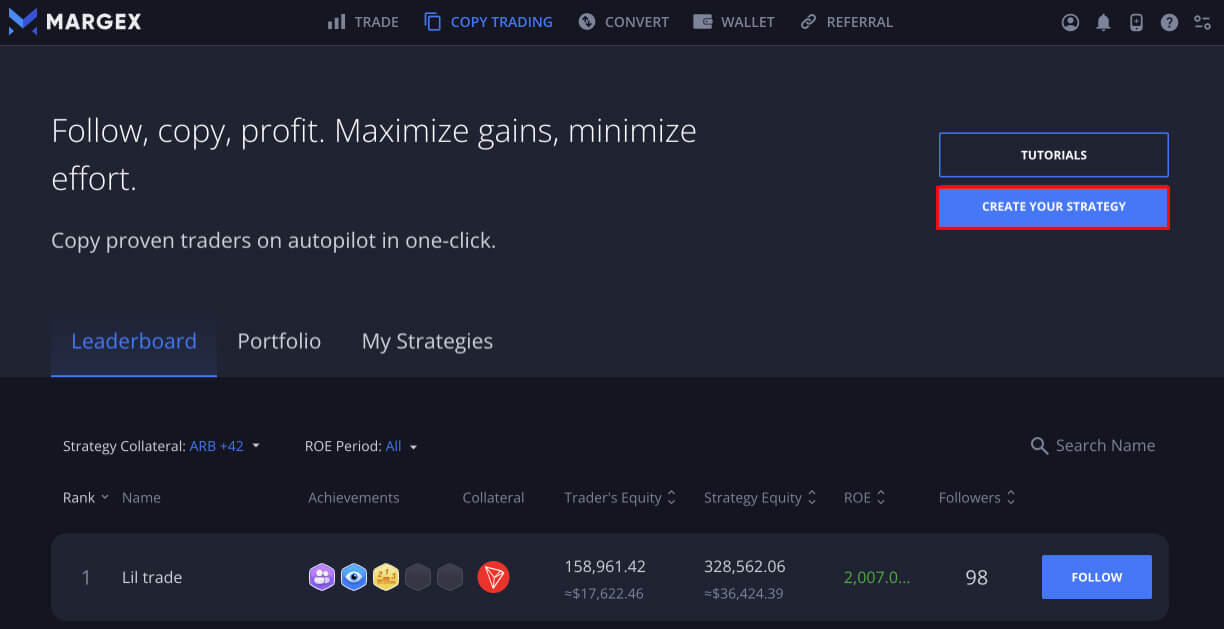

Margex is a number one cryptocurrency replica trading platform that allows users to repeat the trades of educated traders. This offers users the chance to explore digital sources with exact-world consume cases and better earnings doable.

Margex has spent over $3 million redesigning its platform, focusing on usability. It introduced a nil-rate converter to enable users to swap tokens with out disaster with no charges. Margex plans to unveil an ultra-favorite pockets that offers users mighty security to sources and helps them own stout custody of sources within the same platform.

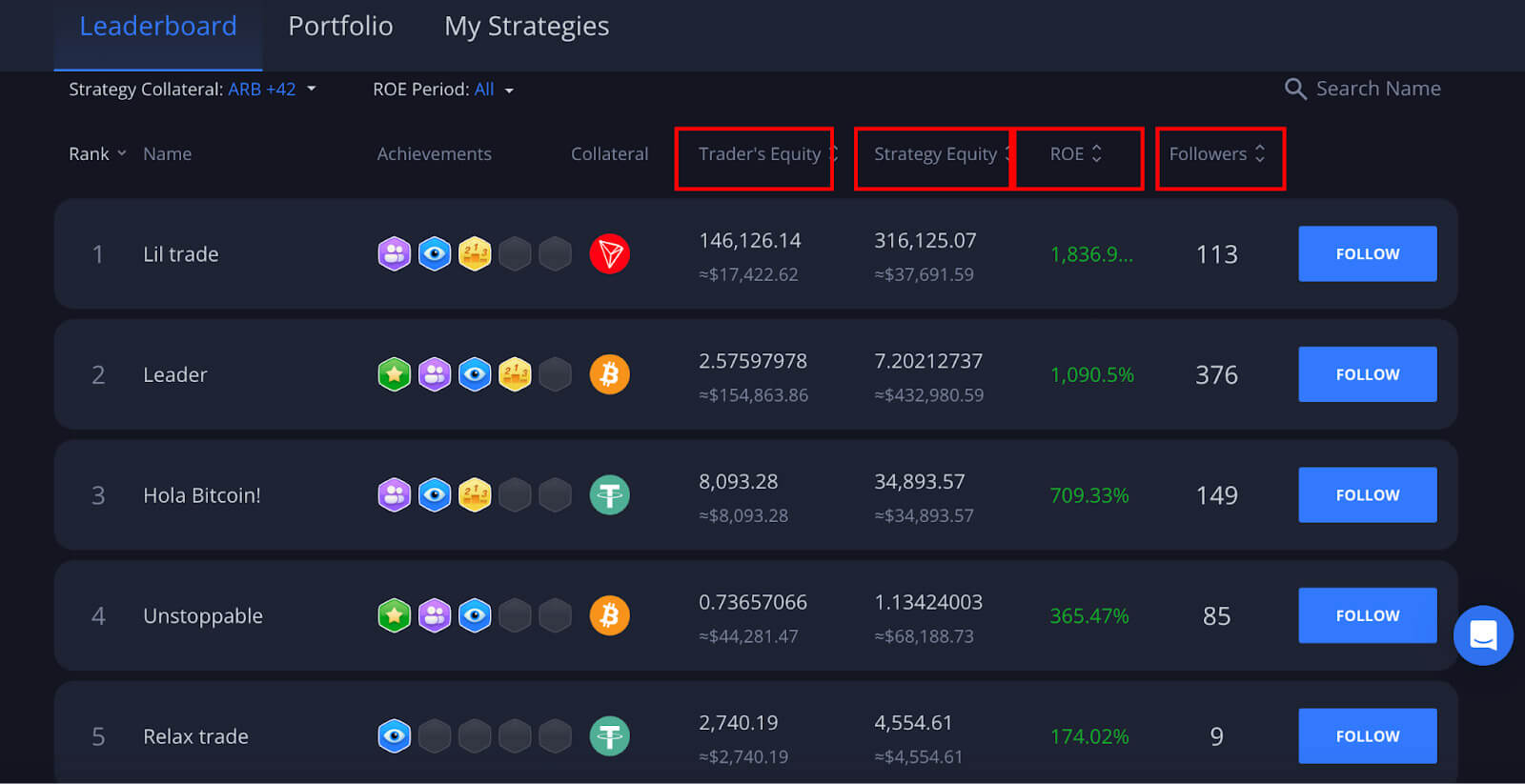

Margex’s plan of its replica trading platform offers users an edge over assorted platforms. It permits users to replica the explicit traders with over 90% safe rate and factual probability administration of users’ sources. Above all, trades are accomplished automatically with out mighty monitoring.

Exploring Margex replica trading and incomes mouth-watering returns from computerized trades has never been more straightforward. Right here's a three-step activity for using the Margex replica trading procedure.

1 Develop A Margex Tale

Creating a Margex permits users to get hold of staunch of entry to its replica trading.

2 Advise Worthwhile Professional Merchants

Advise your most favorite educated vendor to repeat all trades and solutions automatically. Margex replica trading leaderboards provide your entire recordsdata users have to own the most informed resolution about which educated vendor to replica.

3 Allocate Funds To Automate Copy Buying and selling

All trades accomplished in exact-time enable users to replica the procedure or own a realizing that suits them after allocating their desired amount to be entered per alternate.

As low as $10 is the minimum amount Margex requires to take part in replica trading solutions.

Source credit : cryptoslate.com