Using Power Laws to predict when the Bitcoin price will hit $1 million

The exercise of Energy Approved guidelines to foretell when the Bitcoin designate will hit $1 million

The exercise of Energy Approved guidelines to foretell when the Bitcoin designate will hit $1 million The exercise of Energy Approved guidelines to foretell when the Bitcoin designate will hit $1 million

Within the contemporary bull bound, a brand contemporary predictive model per trendy vitality licensed guidelines emerges, doubtlessly forecasting Bitcoin's future prices with unparalleled precision.

Quilt art work/illustration through CryptoSlate. Image includes mixed articulate that can simply consist of AI-generated articulate.

The next is a guest post by Rajagopal Menon, the Vice President of WazirX.

Reach the bull market, cometh the units to foretell the cost of Bitcoin. Within the preferrred bull market in 2021, the Stock-to-Trip (S2F) model became the flavour of the season. This model, created by Opinion B, assessed asset shortage by comparing stock to annual production. Applied to Bitcoin, the S2F model emphasised its âdigital goldâ capability and equipped shortage-based, long-term designate forecasts. On the opposite hand, the S2F model primitive in the crypto winter in 2022.

But effort not, in the contemporary bull bound, there’s a brand contemporary model in metropolis â the Energy Guidelines Mannequin, claiming to foretell the cost of Bitcoin with excellent accuracy.

Working out Energy Approved guidelines

In a world seemingly stuffed with chaos and randomness, scientists bear uncovered hidden patterns and relationships identified as vitality licensed guidelines. These licensed guidelines provide a framework for realizing how assorted phenomena interact, revealing constant mathematical patterns that govern diversified aspects of our universe.

Energy Approved guidelines in Day after day Lifestyles

Energy licensed guidelines are inviting mathematical relationships that seem in a gargantuan quantity of phenomena, offering insights into the underlying simplicity of complex systems. They mutter how two portions divulge to one but another, with a switch in a single quantity leading to a proportional switch in the opposite. This relationship spans assorted scales, from the microcosmic to the cosmic, influencing biology, society, technology, and natural phenomena.

The Size Limits of Animals

Galileo’s square-cube law is a traditional instance of a vitality law in nature, explaining how an animal’s size impacts its energy. As animals grow larger, their quantity and weight do larger unparalleled faster than their energy. This law sets natural limits, explaining why larger animals bear thicker bones and why the largest animals are prove in aquatic environments the place buoyancy offsets weight.

Metabolic Charges

Max Kleber’s study on metabolic rates extra demonstrates the applicability of vitality licensed guidelines. It unearths that an organism’s metabolic price scales to the ¾ vitality of its mass, indicating that larger animals are extra vitality-environment pleasant. This conception vastly impacts realizing species’ lifecycles, increase rates, and sustainability.

Natural Phenomena and Human Activities

Energy licensed guidelines govern various phenomena, from the distribution of earthquake magnitudes to the frequency of words in a language. They prove why we interrogate a small quantity of powerful occasions alongside a gargantuan quantity of smaller conditions. As an illustration, Zipf’s law describes be conscious frequency in languages, highlighting the disproportionate incidence of classy words when in contrast to less frequent ones.

Previous Natural Phenomena

Energy licensed guidelines lengthen into human activities esteem economics, finance, and technology. They elucidate wealth distribution, the place a few folks appreciate a broad share of wealth. In technology, vitality licensed guidelines mutter how articulate interacts on the net, with a few extremely standard nodes and a great deal of less standard ones forming a long tail distribution.

Bitcoin’s Energy Guidelines

Astrophysicist Giovanni Santasi chanced on this connection. He says that 15 years of data prove that Bitcoin also follows a vitality law conception. Santostasi first shared the vitality law model in the r/Bitcoin subreddit in 2018. On the opposite hand, it witnessed a resurgence in January after finance YouTuber Andrei Jeikh talked about it to his 2.3 million subscribers in a video.

Giovanni’s conception says that Bitcoin’s designate isn't as random because it looks. There's randomness to it, however over the future, Bitcoin designate follows a relate mathematical model. It’s not staunch a mathematical formula that some guy drew a line via; as a replace, it follows a vitality law esteem those seen all over the universe.

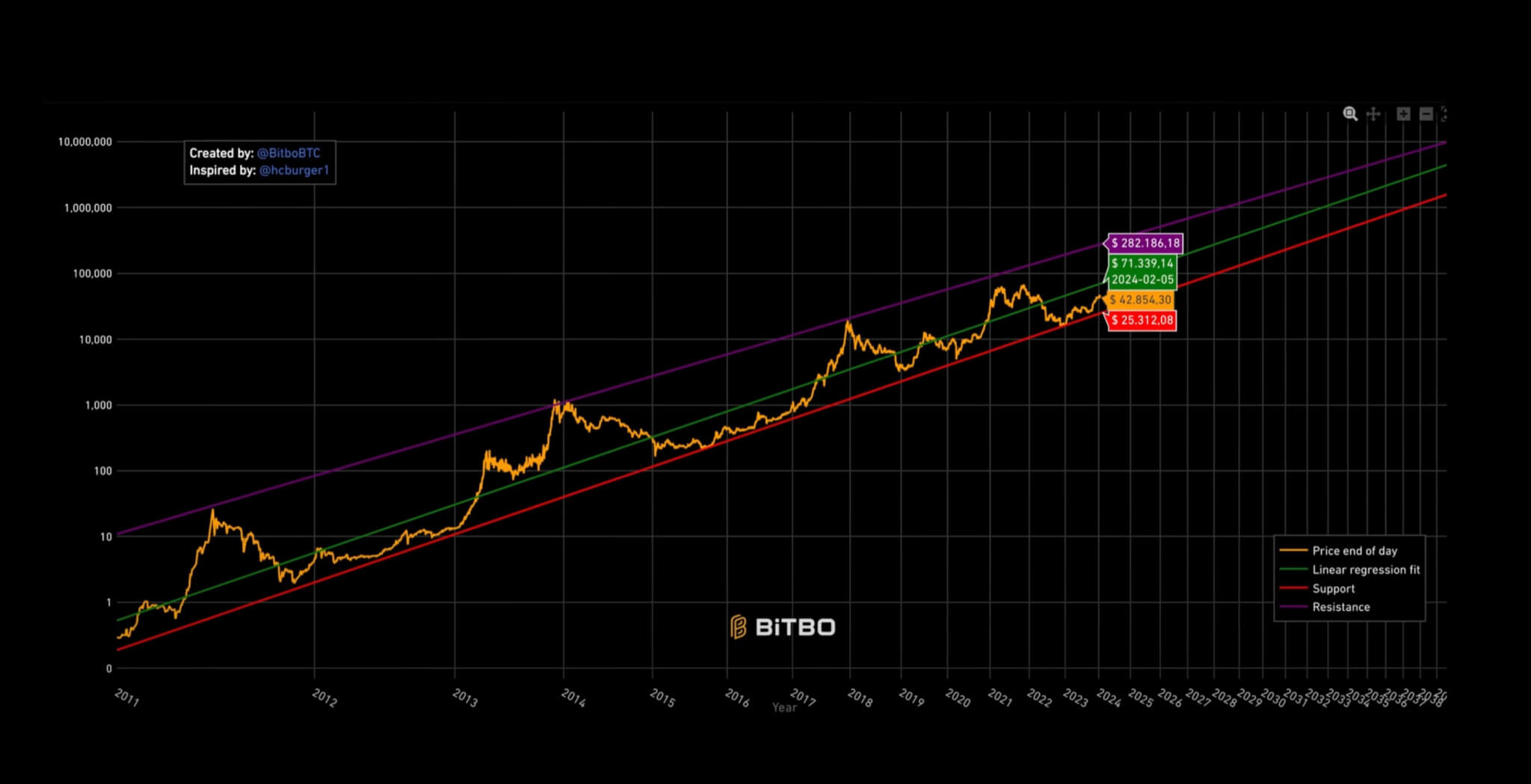

The yellow line represents the contemporary designate, and the purple line represents the improve line, the level Bitcoin on the total never drops below. The inexperienced line is the linear regression line, which is esteem the very best cost designate, the place Bitcoin will at preferrred return to, and the purple line is the resistance line that Bitcoin typically maxes out at.

Predicting Bitcoin’s Future

Santostasi’s Energy Guidelines Mannequin charts Bitcoin’s designate trajectory with excellent precision. It items a graph showcasing Bitcoin’s recent designate, a improve line indicating the level Bitcoin typically doesn’t topple below, a linear regression line representing a truly best cost designate, and a resistance line marking the level Bitcoin typically reaches earlier than a downturn.

This model underscores the remarkably linear increase of Bitcoin, in particular evident when outliers are eradicated. Despite occasional fluctuations, Bitcoin’s total trajectory follows a discernible pattern paying homage to other phenomena ruled by vitality licensed guidelines.

Implications for Merchants

The Energy Guidelines Mannequin presents intriguing insights into Bitcoin’s capability future peaks. Santostasi’s analysis means that Bitcoin may per chance height at $210,000 in January 2026, adopted by a subsequent decline to around $60,000. He goes on to foretell that Bitcoin will likely be price $1 million in July 2033. Whereas mathematical units provide precious insights, they're not resistant to errors and may per chance simply fail to myth for unforeseen occasions that can vastly influence prices.

âAll units are damaged however some are valuable” procedure that whereas units may per chance simply not be very best, they can peaceful provide precious insights. Objects, esteem the vitality law model or the stock-to-amble model for predicting Bitcoin’s designate, bear their flaws and bounds. As an illustration, Julio Marino from Crypto Quant identified components with the vitality law model, equivalent to underestimating errors and giving a deceptive influence of accuracy.

Curiously, both the vitality law and stock-to-amble units bear confronted identical criticisms. Despite their flaws, they bear got historically made almost the same predictions for Bitcoin’s designate. On the opposite hand, over time, they're going to simply diverge in their forecasts.

The interrogate arises: if these units are very best, why agonize with ragged investment programs esteem the 60/40 portfolio? Some argue that contemporary units explaining Bitcoin’s habits may per chance offer better returns.

Whereas some may per chance imagine these units are nugatory, others, esteem the actual person speaking, imagine they peaceful wait on cost. Shortage, driven by Bitcoin’s mounted supply, performs a role in its designate appreciation. Additionally, components esteem M2 increase also affect Bitcoin’s designate.

Whereas units can provide valuable insights, they can't predict the future. Even supposing units bear flaws, Bitcoin’s trajectory looks upward. So, whereas it’s valuable to bear in solutions these units, it’s also valuable to acknowledge their boundaries.

Source credit : cryptoslate.com