Polygon leads in EVM efficiency as DeFi users favor low transaction costs

Polygon leads in EVM effectivity as DeFi users decide on low transaction costs

Polygon leads in EVM effectivity as DeFi users decide on low transaction costs Polygon leads in EVM effectivity as DeFi users decide on low transaction costs

DeFi job diagnosis finds facet chain solutions love Polygon more label-effective, even supposing Ethereum secures most transaction expenses.

Quilt art/illustration through CryptoSlate. Image involves mixed speak material that can per chance consist of AI-generated speak material.

Layer-1 blockchains are foundational networks supporting varied applications straight away on their protocol, while Layer-2 blockchains operate atop these foundational layers, bettering scalability and effectivity. Comparing the usage and effectivity of EVM-love minded L1 and L2 blockchains and facet chains helps us greater perceive the market values and where quite so much of the DeFi job comes from.

Dune Analytics records analyzed by CryptoSlate confirmed Polygon, a Layer-2 sidechain, turned into the leading decide in the DeFi ecosystem, carefully followed by BNB Chain, an EVM-love minded Layer-1 blockchain.

Conception to be one of many largest metrics when examining L1s and L2s is the day to day gasoline usageâthe computational effort required to develop operations on the blockchain. Gasoline expenses are paid in native blockchain currencies, and excessive gasoline usage generally indicates sturdy community job. Notably, when L2 solutions get excessive gasoline usage at low USD costs, it reflects an atmosphere friendly scaling solution that makes transactions reasonable with out sacrificing blockchain job.

Polygon utilizes a median of 579.97 billion items of native gasoline day to day, with linked costs amounting to honest appropriate $65.48k. This translates to a meager average of $0.76 in USD per 2d no matter processing a excessive quantity of 48.37 transactions per 2d. Each and every transaction on Polygon costs about 138,782 gasoline items. BNB Mainnet, while furthermore excessive in transaction quantity, reveals a varied label construction with 454.89 billion items of native gasoline passe day to day and $1.02 million in day to day USD expenses; the cost per 2d soars to $11.81, a long way surpassing Polygon’s. The larger label per transaction, which averages 108,513 gasoline items, reflects BNB’s heavier computational query per transaction, suggesting a more helpful resource-intensive operation than Polygon.

| Chain | Avg Native Gasoline Extinct / Day | Avg USD Gasoline Prices / Day | Avg # Txs / Day | Avg Native Gasoline per Tx | Avg Native Gasoline Extinct / Second | Avg USD Gasoline Prices / Second | Avg # Txs / Second |

|---|---|---|---|---|---|---|---|

| Polygon Mainnet | 579.97b | $65.48k | 4.18m | 138,782 | 6.71m | $0.76 | 48.37 |

| BNB Mainnet | 454.89b | $1.02m | 4.06m | 108,513 | 5.26m | $11.81 | 47.03 |

| Arbitrum One | 273.96b | $250.05k | 1.14m | 241,207 | 3.17m | $2.89 | 13.15 |

| Corrupt Mainnet | 222.37b | $378.72k | 1.26m | 174,229 | 2.57m | $4.38 | 14.59 |

| OP Mainnet | 213.30b | $160.26k | 490.83k | 429,129 | 2.47m | $1.85 | 5.68 |

| Gnosis Mainnet | 109.77b | $1.05k | 182.58k | 601,244 | 1.27m | $0.01 | 2.11 |

| Ethereum Mainnet | 108.14b | $12.63m | 1.19m | 90,758 | 1.25m | $146.20 | 13.79 |

| Fantom Mainnet | 94.86b | $4.89k | 248.93k | 372,521 | 1.10m | $0.06 | 2.88 |

Arbitrum uses 273.96 billion items of gasoline day to day, costing users $250.05k, which breaks down to $2.89 per 2d and 241,207 gasoline items per transaction, indicating an even bigger label effectivity than BNB however much less so than Polygon. Corrupt Mainnet records linked trends with 222.37 billion items and day to day expenses of $378.72k, ensuing in a reasonably bigger per-2d label of $4.38 and 174,229 items per transaction.

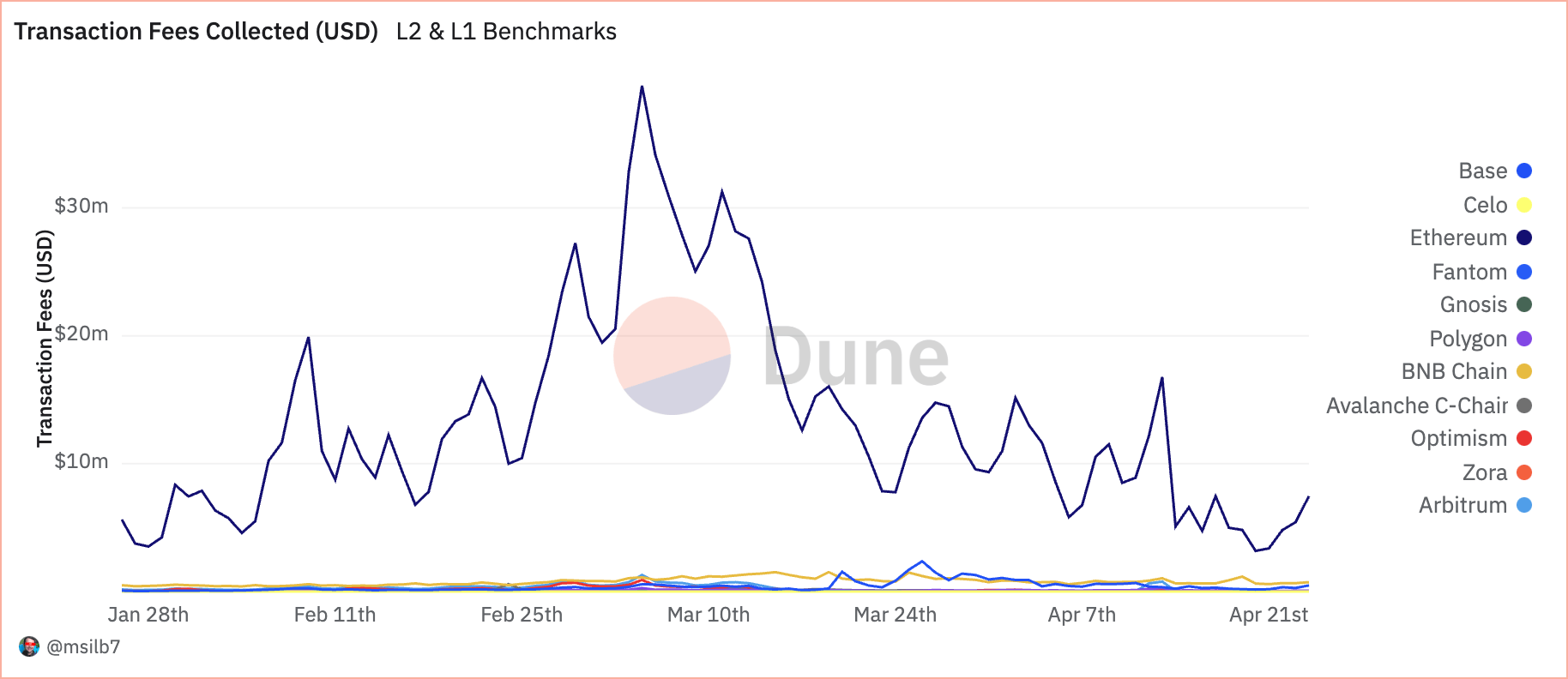

Ethereum operates with the finest label affect, utilizing 108.14 billion gasoline items day to day, translating staunch into a hefty $12.63 million in expenses. With costs skyrocketing to $146.20 per 2d, no matter getting a median of 90,758 gasoline items per transaction, it illustrates Ethereum’s sturdy safety and computational breadth and highlights its scalability challenges that L2 networks intention to deal with.

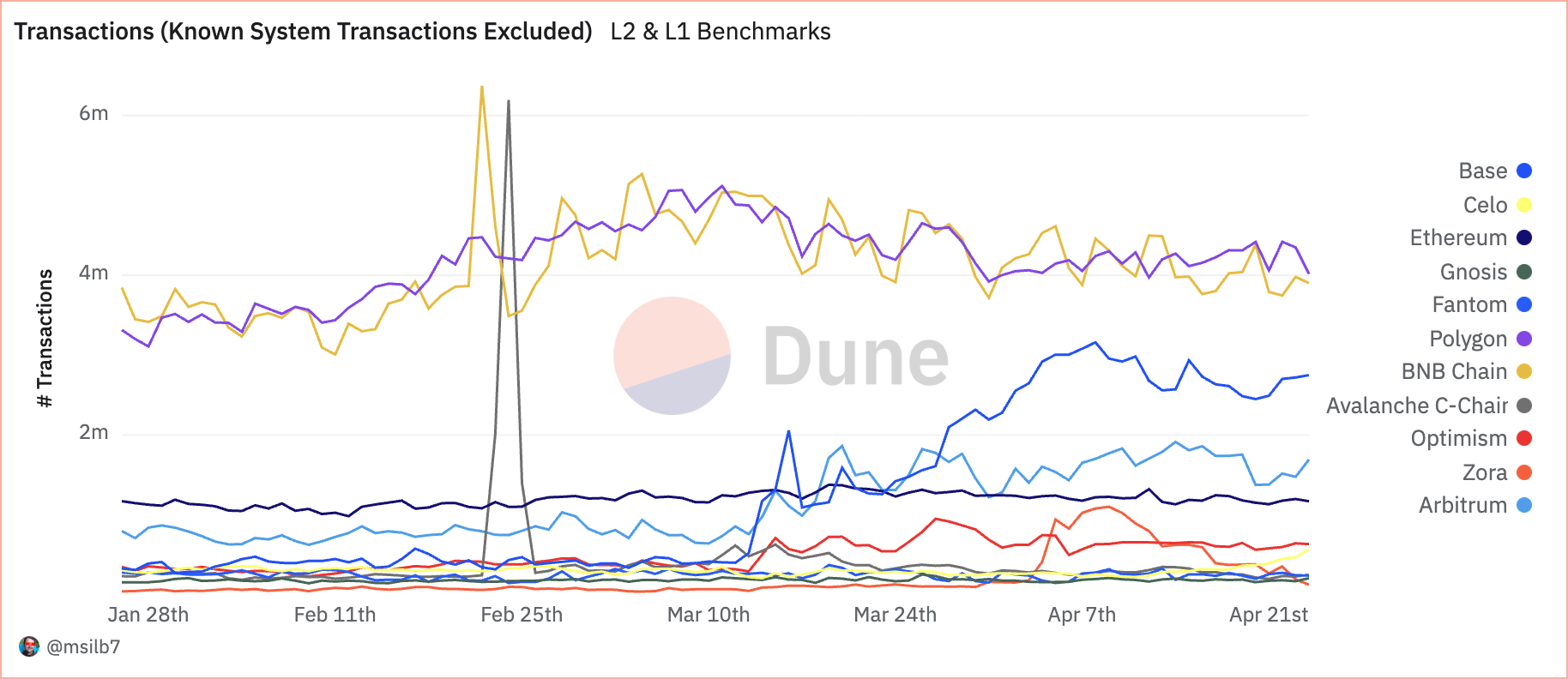

Taking a study transaction metrics, records from April 23 reveals that Polygon led with 4.02 million transactions, followed by BNB Chain with 3.9 million. These figures impress sturdy person engagement and community utility, representing a respective 25.8% and 25.1% share of total transactions (excluding identified system transactions).

Nonetheless, when examining transaction expenses, a varied account emerges. Despite a lower transaction depend, Ethereum accumulated $7.46 million in expenses, representing a staggering 83.9% of total expenses amassed. This discrepancy suggests that while Ethereum processes fewer transactions, its bigger transaction costs replicate its foremost layer map and the intensive computational resources required for operations.

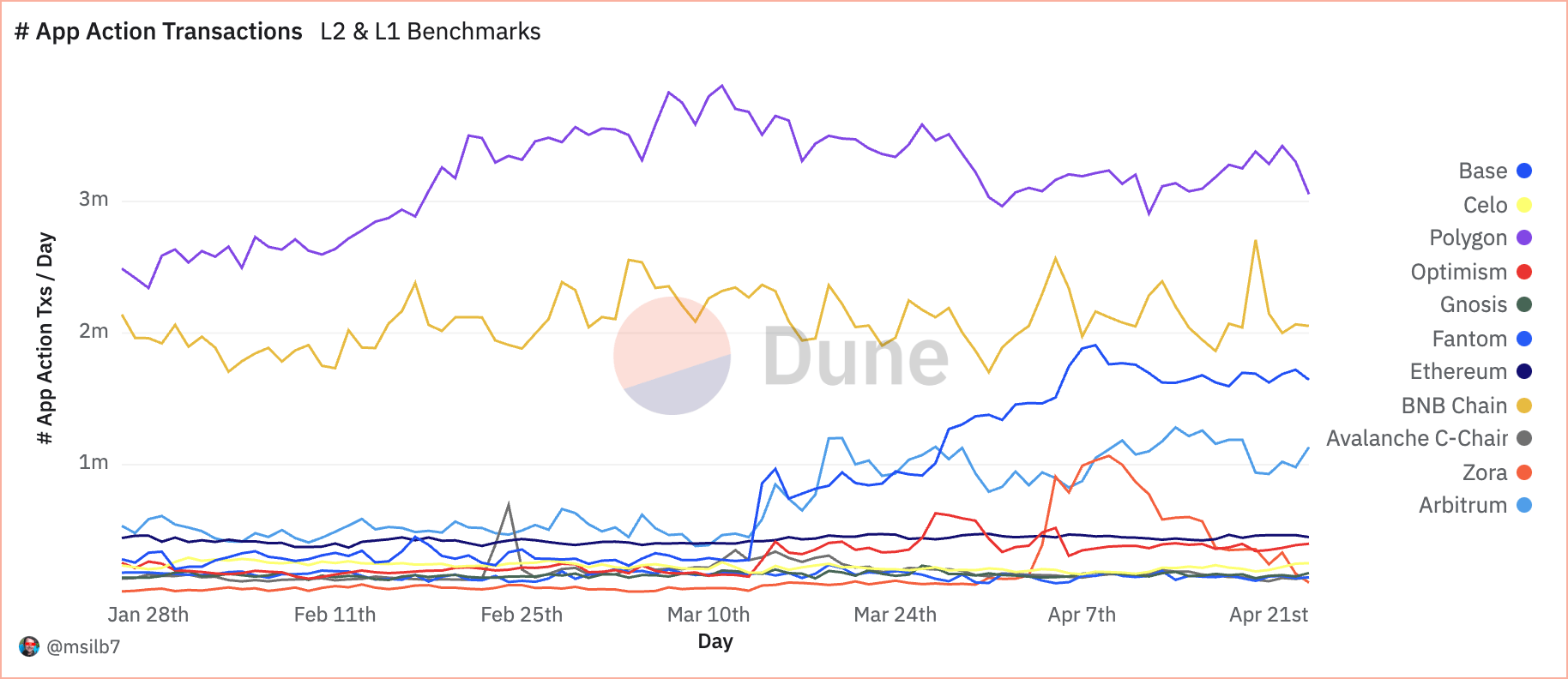

By manner of DeFi apps, Polygon again leads the transaction numbers, with 3.3 million app transactions, showing it’s a inch-to platform for DeFi activities.

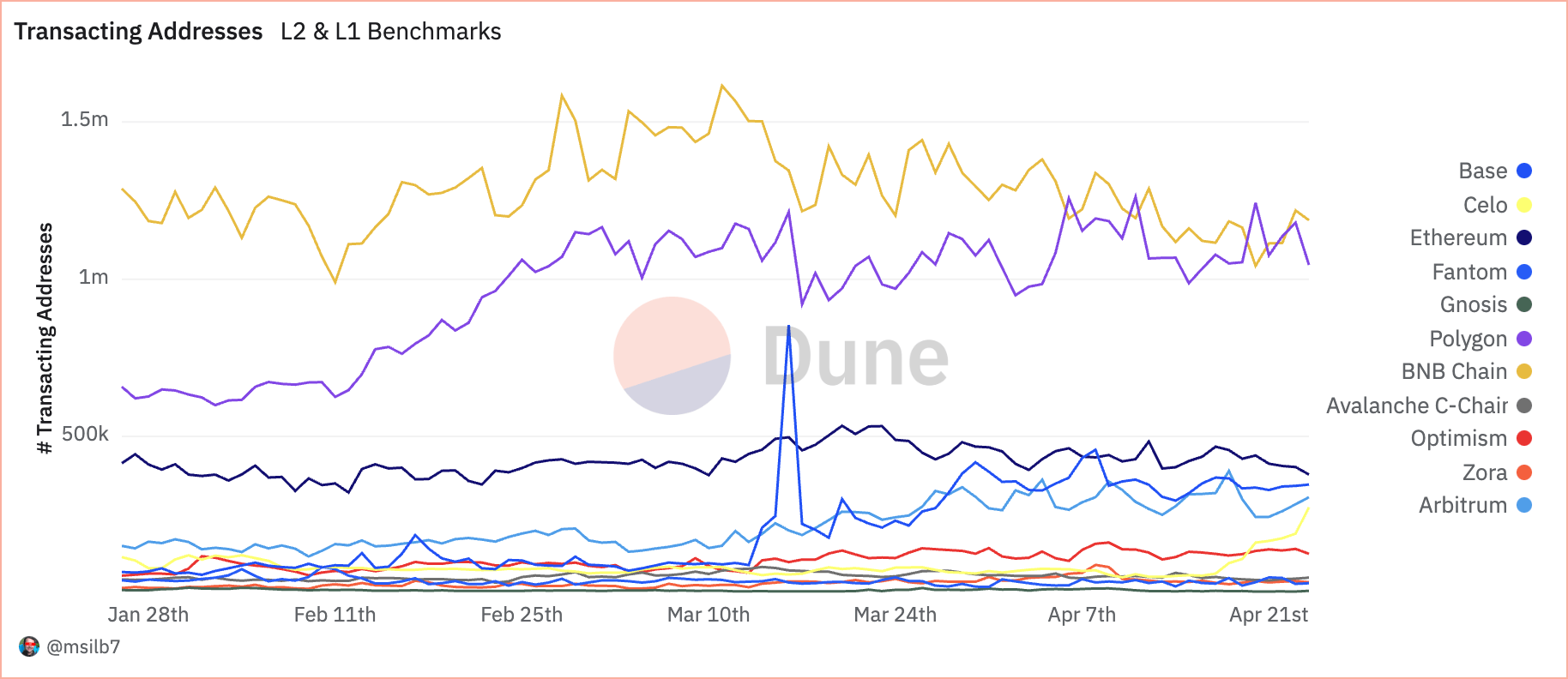

BNB Chain saw 1.22 million transacting addresses, with Polygon a little bit on the serve of at 1.18 million. These figures, contrasted with Ethereum’s 402.77k, counsel that varied EVM-love minded networks are turning into most standard platforms for traditional DeFi users ensuing from their lower rate constructions.

Inspecting the efficiency of these blockchains facet-by-facet reveals a fight between foundational safety and enhanced scalability. Whereas L1 blockchains love Ethereum continue to valid excessive-label transactions with tall expenses, scaling solutions love Polygon capture the bulk of day to day transactions and application interactions, signifying a shift in the direction of more atmosphere friendly and person-friendly blockchain infrastructures in DeFi.

It’s significant to impress that no matter being labeled as a Layer-2 blockchain by many, Polygon operates as an L2 sidechain for Ethereum, as it relies on its possess role of validators and doesn’t depend on Ethereum for safety. This allows Polygon to make stronger more experimental job than “lawful” L2 blockchains with out impacting Ethereum. One other truth price pointing out is that BNB Chain is an EVM-love minded Layer-1 blockchain however has positioned itself in the marketplace no longer as a competitor to Ethereum, one more L1, however to varied L2s.Â

Mentioned listed here

Source credit : cryptoslate.com