Institutions look to deploy Bitcoin as liquidity to Lightning Network to earn yield

Institutions watch to deploy Bitcoin as liquidity to Lightning Network to make yield

Institutions watch to deploy Bitcoin as liquidity to Lightning Network to make yield Institutions watch to deploy Bitcoin as liquidity to Lightning Network to make yield

LQWD and Amboss accomplice to add fresh liquidity to Lightning to foster further adoption.

Quilt art/illustration by CryptoSlate. Image comprises mixed pronounce which may simply consist of AI-generated pronounce.

Bitcoin Lightning Network liquidity provider LQWD Applied sciences has partnered with Amboss Applied sciences to construct further institutional liquidity on Lightning. The collaboration positions LQWD to contribute liquidity to Amboss’s market, enabling the success of market search info from for Lightning Network liquidity whereas producing a yield on LQWD’s Bitcoin holdings.

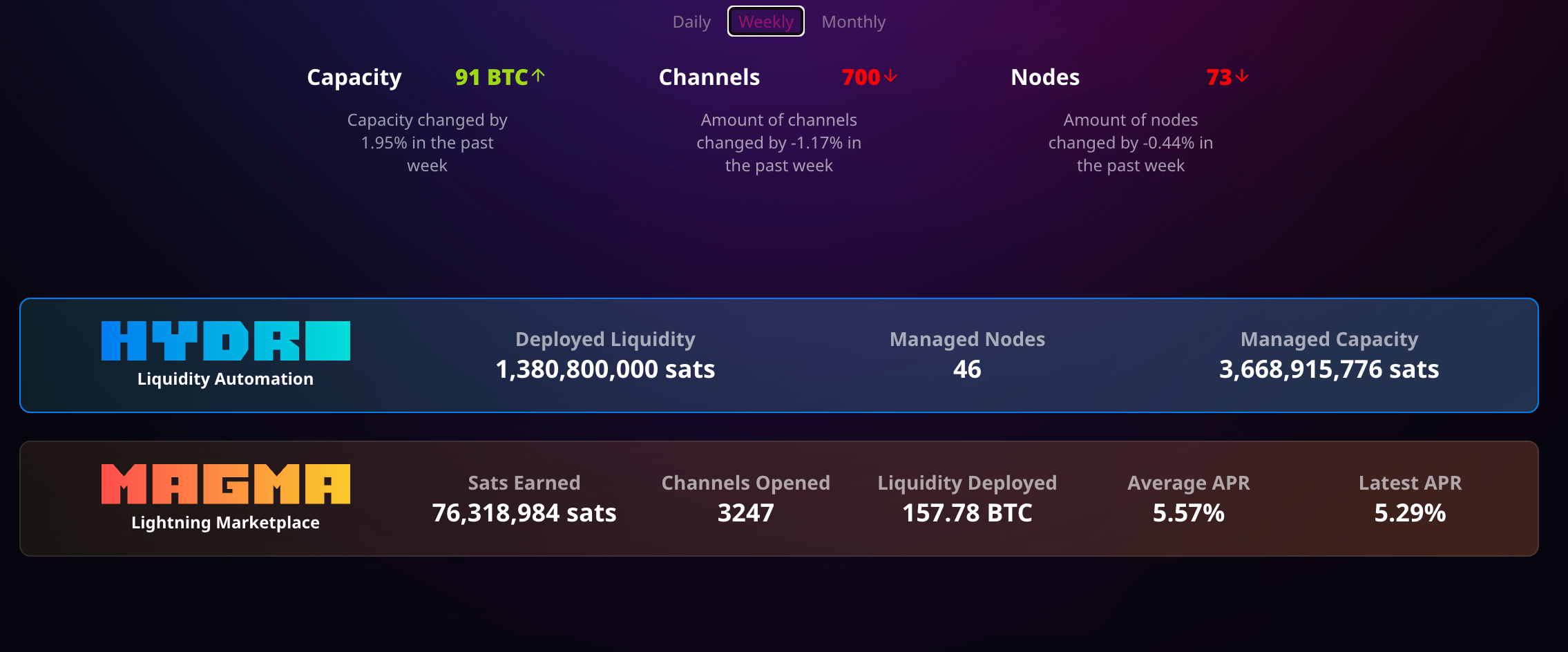

Amboss, a provider of information analytics choices and payments operations on Lightning, presents in actual fact good merchandise akin to Magma, a liquidity market, and Hydro, a fancy liquidity automation tool. These merchandise purpose to make an intellectual market and facilitate payments on the Lightning Network. As a liquidity provider, LQWD will launch an preliminary tranche of Bitcoin to Amboss, with plans to deploy extra Bitcoin all thru the partnership.

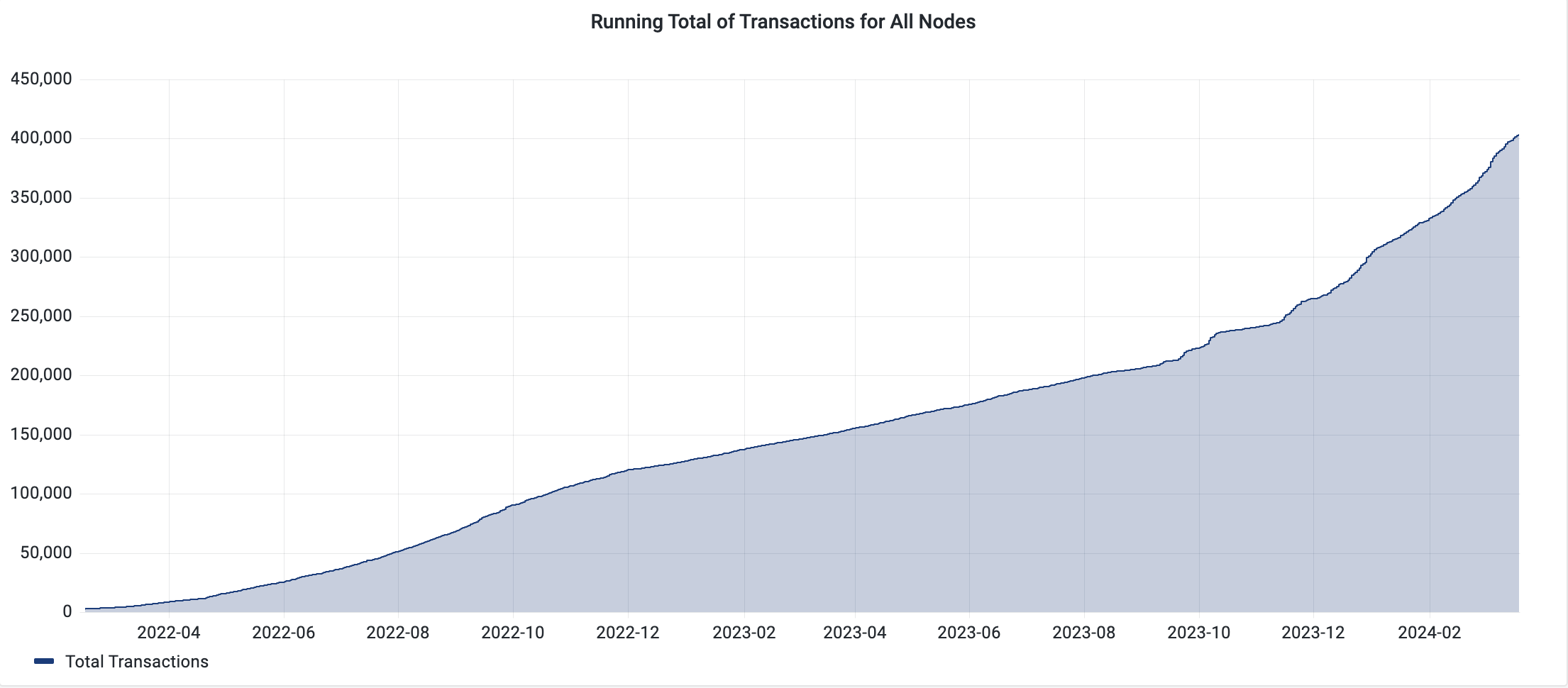

LQWD has considered consistent boost in its Lightning Network transactions since 2022, just not too lengthy within the past surpassing 400,000, per self-reported info.

Amboss customers will carry out liquidity from LQWD, permitting the latter to make preliminary and routing payments for transactions over the Lightning Network. Shone Anstey, CEO of LQWD, emphasised the importance of the partnership, stating, “This strategic alliance signifies a predominant step ahead for both LQWD and Amboss as we work together to enhance liquidity and efficiency internal the Bitcoin Lightning Network ecosystem.”

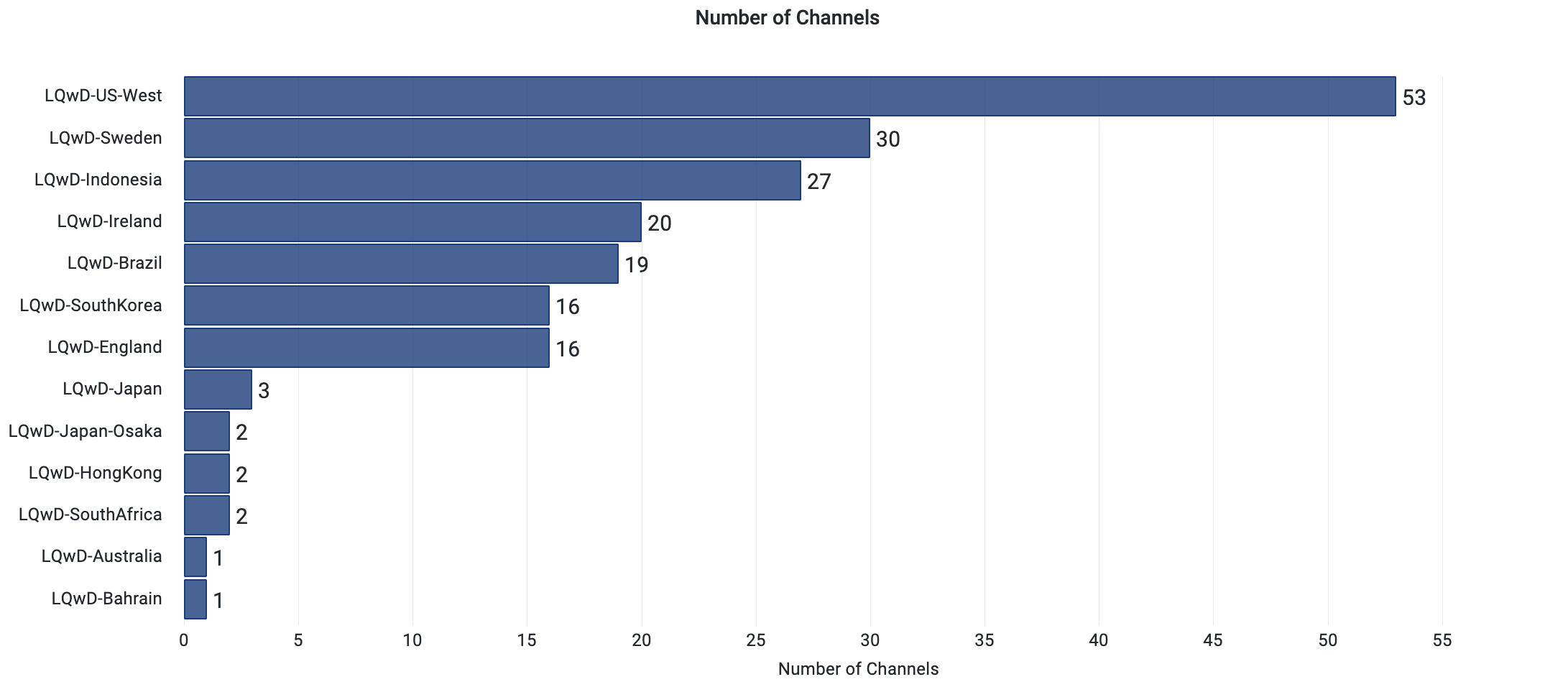

LQWD also presents Lightning channels in a lot of geographies, with the majority being on the West Cruise of the US. Interestingly, after the US, Sweden, Indonesia, Eire, and Brazil possess essentially the most active channels.

The partnership permits LQWD to deploy its firm-owned Bitcoin whereas doubtlessly shooting predominant transaction volume and producing yield on its holdings. Importantly, LQWD maintains beefy sovereignty and custody at some stage all thru, aligning with its tackle increasing fee infrastructure and choices accelerating Bitcoin adoption thru the Lightning Network.

Amboss’ market for the time being presents a 5.57% APR on Bitcoin deployed thru Lightning Channels with entire liquidity of 157 BTC, roughly $10 million as of press time.

Jesse Shrader, Co-Founder and CEO of Amboss, highlighted the advantages of the collaboration, stating,

“Partnering with LQWD ensures that Amboss’s global customers possess state access to institutional-grade liquidity for Bitcoin payments, permitting LQWD to generate extra yield thru their nodes on the Lightning Network. Additionally, this partnership increases the provision aspect of Amboss’s liquidity market.”

LQWD also makes exercise of its have Bitcoin as an working asset to construct nodes and fee channels on the network. With the partnership between LQWD and Amboss, both corporations are alive to to contribute to the enlargement and efficiency of the Bitcoin Lightning Network ecosystem, providing enhanced liquidity choices for corporations and shoppers alike.

Source credit : cryptoslate.com