Memecoin volumes are just vanity metrics for desperate blockchains

Memecoin volumes are factual conceitedness metrics for desperate blockchains

Memecoin volumes are factual conceitedness metrics for desperate blockchains Memecoin volumes are factual conceitedness metrics for desperate blockchains

Memecoin activity fails to stimulate accurate adoption as Solana, Avalanche gamble on playing.

Duvet art work/illustration through CryptoSlate. Image contains mixed tell which would maybe maybe maybe presumably furthermore consist of AI-generated tell.

There’s a faulty perception that memecoins are helping other folks out of poverty that I imagine is de facto detrimental to the home. More so, I feel chains like Solana and Avalanche, that are seeing increased attention due to memecoin fervor, are extremely overheated. Essentially, memecoin volumes are conceitedness metrics equivalent to likes and followers on social media platforms and not using a valid substance.

Anyone who works on web2 will know that the valid KPIs of social media engagement lie in engagement, user-generated tell, link clicks, and sales conversions. Likes and followers are essentially appropriate for little bigger than self-serving egotism. In Web3, the on-chain metrics that networks wants to be troubled with are being augmented with ‘fraudulent’ memecoin web site visitors, which is in a field to descend off the moment the novelty of the shitcoin on line casino fades away.

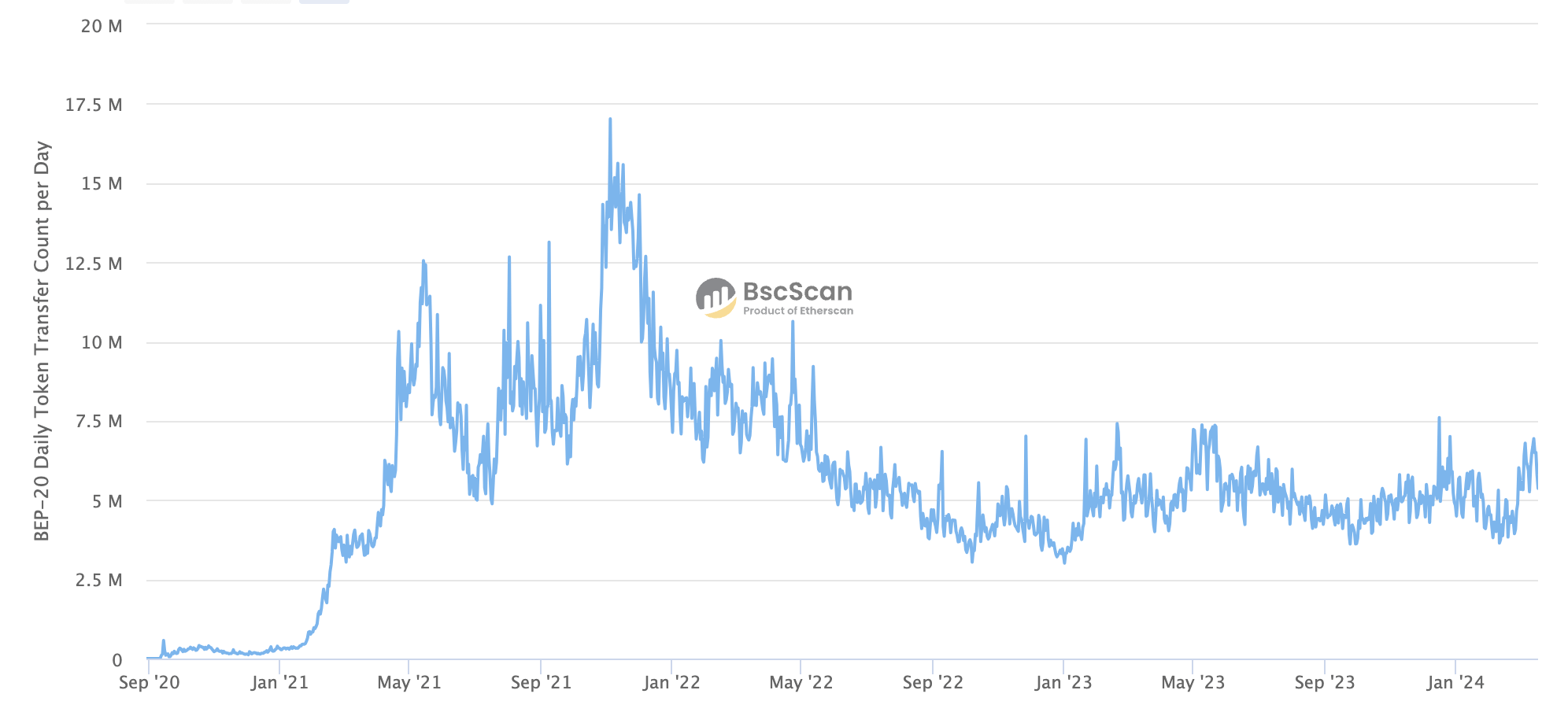

Look at on the OG memecoin community, BNB Chain, which seen a giant surge in usage in 2021 due to memecoin trading on PancakeSwap. It reached around 17 million token transactions per day in 2021 nonetheless has since called to around 5 million. Composed, 5 million token transfers a day appears like a wholesome metric, correct?

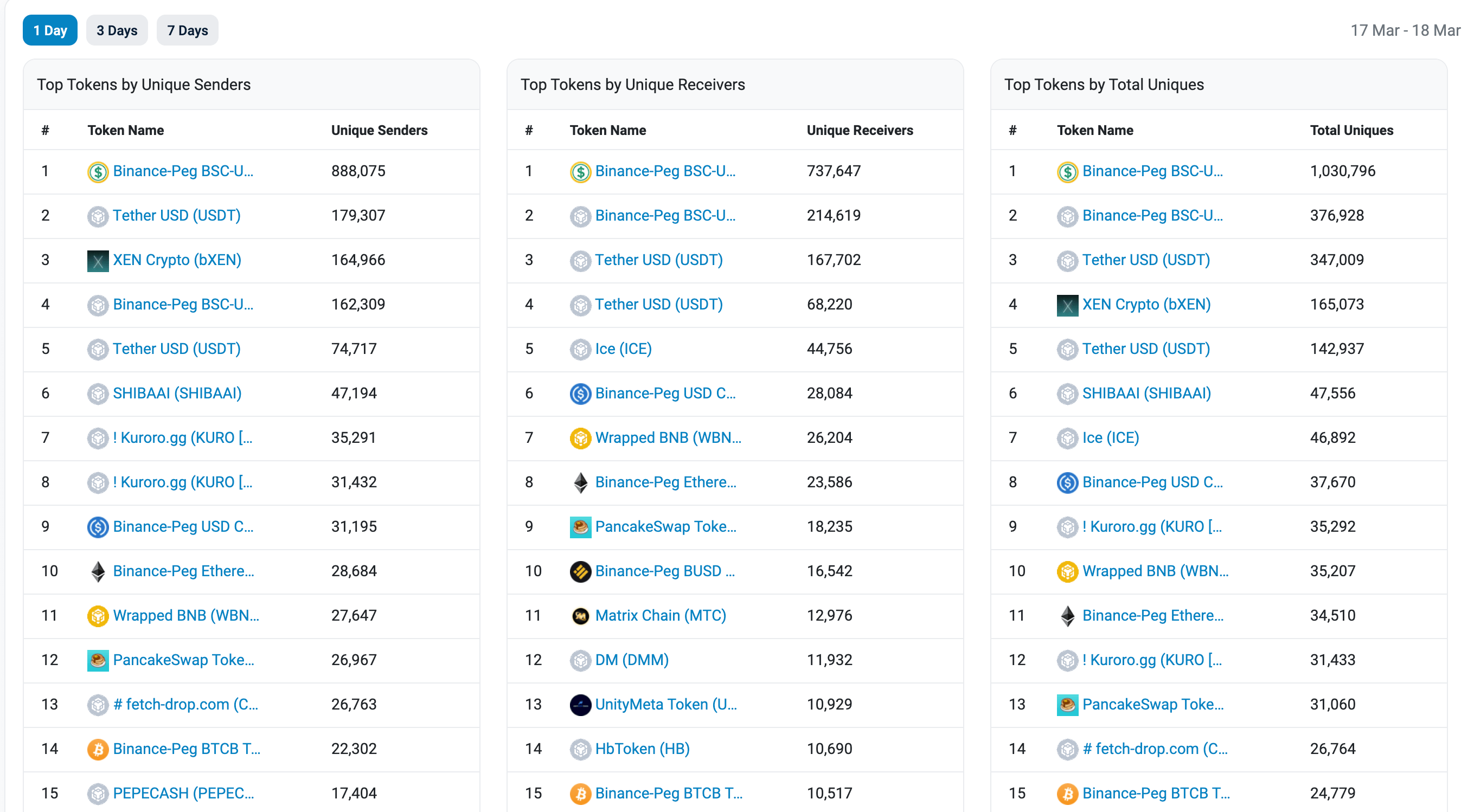

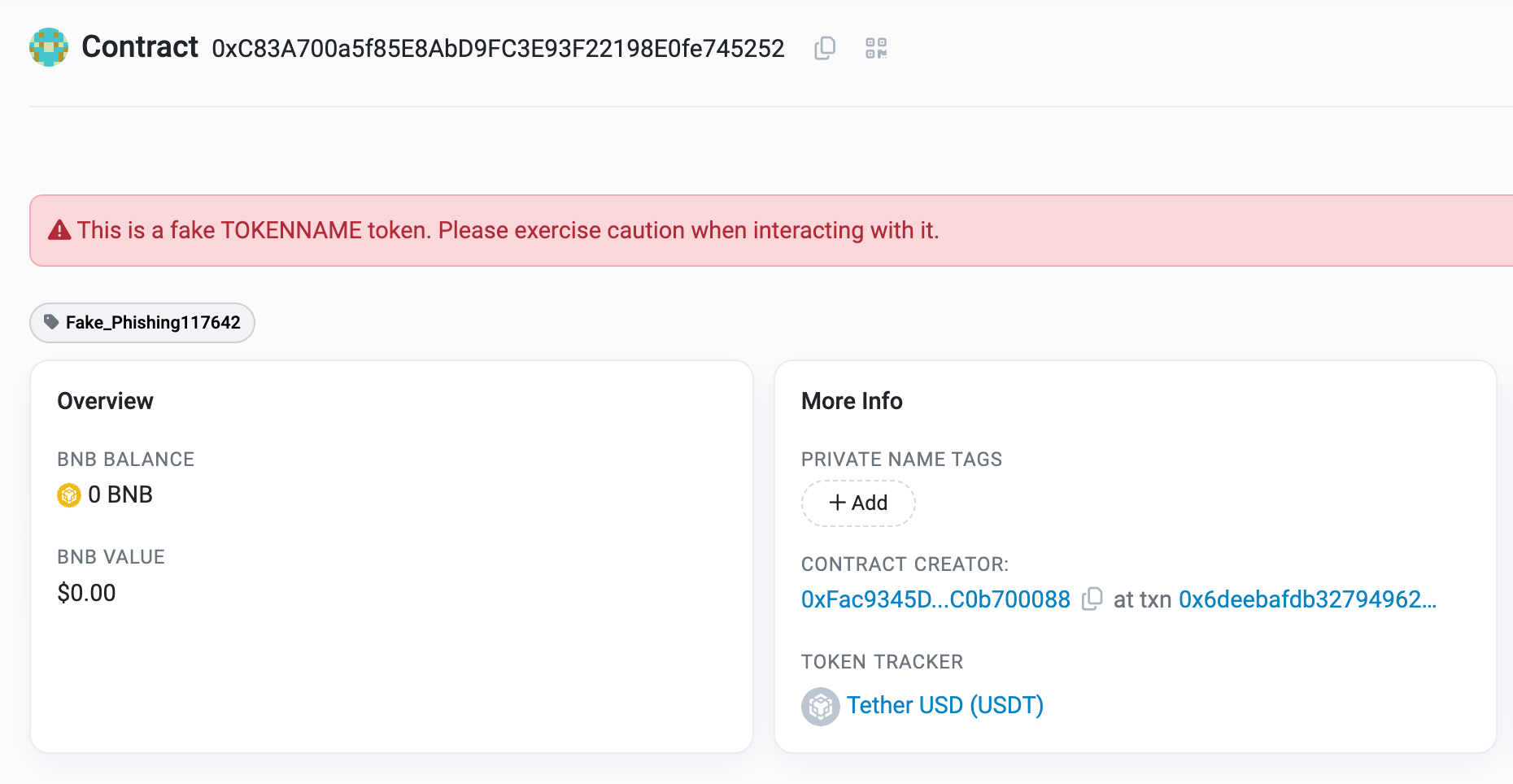

On the opposite hand, after we be pleased a look on the head tokens being transferred on-chain, we glance that most are either memecoins or fraudulent rip-off tokens, in step with BSC Scan.

The majority of tokens within the image above without a mark are rip-off tokens designed to trick users into trading them to rob funds. As an illustration, the USDT token with 1.2 million peculiar transfers for the duration of the last seven days is no longer an valid token issued by Tether.

Solana, with its pre-sale memecoin circus saving its failed cell phone launch and Avalanche pumping its ‘neighborhood token’ financial system by taking a peek for tokens for its treasury, would possibly well maybe presumably furthermore properly finish up like BNB Chain with the direction they're going.

I am no longer against memecoins as a thought, nonetheless I carry out imagine they deserve to be treated like the playing activity they're. In addition, it's some distance likely that Solana and Avalanche will now join BNB Chain as playing networks packed with a combine of rip-off tokens and memes of no subject cloth worth.

Be conscious, memecoin trading is basically Russian roulette, and the arrangement is to no longer be the whales’ exit liquidity.

I became once an early adopter of Dogecoin relieve in 2014 after I mined cash the exhaust of graphics cards from my video production company. On the time, the term ‘memecoin’ wasn’t even a part, as Doge became once the finest one in existence. I became a giant fan of the thought that with a opinion to produce ‘magic web money’ that aligned with the salvage culture of the time. Doge memes had been all of the rage, and thus, Dogecoin became once a stress-free technique to learn about crypto and potentially be a segment of a digital medium of alternate for a world nonetheless learning how to ‘web.’

For entire transparency, I sold all my Doge for Bitcoin in slack 2015 and presently relieve a minimal amount for nostalgia’s sake.

On the opposite hand, the most up-to-date market for memecoins has nothing to carry out with offering a stress-free digital forex that would be venerable to alternate online freely. There will not be one of these thing as a utility to any memecoin rather then hoping that the ‘number drag up.’ Neutral currently, Bitcoin tell creator Layah Heilpern stated,

“Meme cash and shitcoins are truly out right here changing peoples lives. Thereâs no other industry that skill that you simply can drag from broke to millionaire over a span of some weeks and even a number of days.”

These are abominable narratives as they produce other folks think they are able to exchange their lives with memecoins. In fact that most either aquire in too slack or relieve too long. They would maybe maybe maybe furthermore be paper millionaires for a moment, nonetheless they no longer regularly ever materialize profits in Bitcoin or fiat terms. Both their conviction in additional profits stops them from promoting before the market inevitably collapses, or an absence of liquidity hinders their skill to sell.

Cryptoquant founder Ki Younger Ju apparently shares a number of of my views right here commenting this day,

“Meme cash shatter the crypto industry.

It’s disturbing to glimpse billion-buck-cap memecoins overshadow hardworking groups building legit products to advance this industry.

Straightforward money can’t force industry-extensive growth, as shown by the 2018 ICO burst.”

For context, E book of Meme (BOME) reportedly has done a $1b market cap, resulting in an influx of most up-to-date merchants. On the opposite hand, DEX recordsdata confirmed liquidity of around $64 million when it first reached the milestone. Since then, CEX listings be pleased helped push the trading volume to over $2 billion for the duration of the last 24 hours.

Slerf, but some other Solana pre-sale token, reported that the founder had ‘by chance’ burned all of the pre-sale tokens along with the LP before it became once listed on CEXs and has now had $700 billion in volume this day on my own and a market cap of $200 million.

The most talked about memecoin of the previous month, Dogwifhat (WIF) categorically states,

“WIF isn’t factual a cryptocurrency; it’s a image of growth, for futuristic transactions, a beacon at the same time as you watched forward. It’s obvious that the long term belongs to those who embody improvements like WIF, transcending boundaries & paving a original know-how in finance and know-how.”

On the opposite hand, carry out no longer be fooled; no longer like Dogecoin 10 years ago, these “symbols” of growth are designed for one part simplest, to produce somebody rich by dumping on retail patrons playing the shitcoin on line casino lottery.

Chains that alter their focal level to promote the neighborhood side of digital assets to foster innovation and engagement bla bla would possibly well maybe presumably furthermore as properly say what they mean, which is

“Web3 has become so noisy that the finest procedure we are able to glean attention is by turning into a on line casino, nonetheless we don’t are desirous to claim that so we’ll faux right here's about ‘neighborhood.'”

In the phrases of many a millennial mom, “I’m no longer excited, I’m factual upset.” I relieve Solana, BNB Chain, and Avalanche in my portfolio; right here's no longer a transient vendor record. I simply are desirous to lift awareness about memecoins and peel relieve the bs about “neighborhood.” The absolute top meme neighborhood, in my glimpse, became once Dogecoin, nonetheless even the customary builders gave up on that.

So let’s factual name a spade a spade and admit memecoins are playing. Then, add the accurate warnings reasonably than pretending they characterize innovation.

Mentioned listed right here

Source credit : cryptoslate.com