ECB Executive pens November 2025 rollout for digital Euro CBDC

ECB Executive pens November 2025 rollout for digital Euro CBDC

ECB Executive pens November 2025 rollout for digital Euro CBDC ECB Executive pens November 2025 rollout for digital Euro CBDC

Spoil customers to beget maintaining limits but none for corporates as push for digital euro adoption correct thru Europe by unhurried 2025 continues.

Duvet art/illustration by the use of CryptoSlate. Image entails mixed advise which would per chance presumably presumably contain AI-generated advise.

The European Central Financial institution is pushing forward with plans to initiate a digital euro, aiming to execute a pan-European digital price answer that complements money, fixed with Piero Cipollone, Member of the Executive Board of the ECB. Talking at the Convegno Innovative Funds conference, Cipollone outlined the vital scheme decisions and rationale at the support of the digital euro venture, fixed with notes launched on March 13.

As evolving price trends replicate folks’s increasing need for digital payments, the ECB seeks to build lives more accessible by offering a public digital technique of price that can even be light freed from charge for any digital transaction in the euro inform. Cipollone emphasized that the digital euro would bring money-esteem parts to the digital world, being readily accessible offline, free for traditional use, and respectful of privateness whereas having a pan-European attain.

On the other hand, some critics beget raised concerns about the privateness implications of the digital euro. In a unusual post, WalkerAmerica, the host of Bitcoin Bitcoin-centered Titcoin Podcast, expressed skepticism about the ECB’s claims of privateness:

“ECB plans to roll out digital Euro CBDC starting up in 2025 They thunder it’ll be ‘within most,’ but it completely is perhaps no longer, given Lagarde already wishes to throw you in detention middle for a 1000+ euro anonymous money price. Witness #Bitcoin & choose out of this totalitarian surveillance token.”

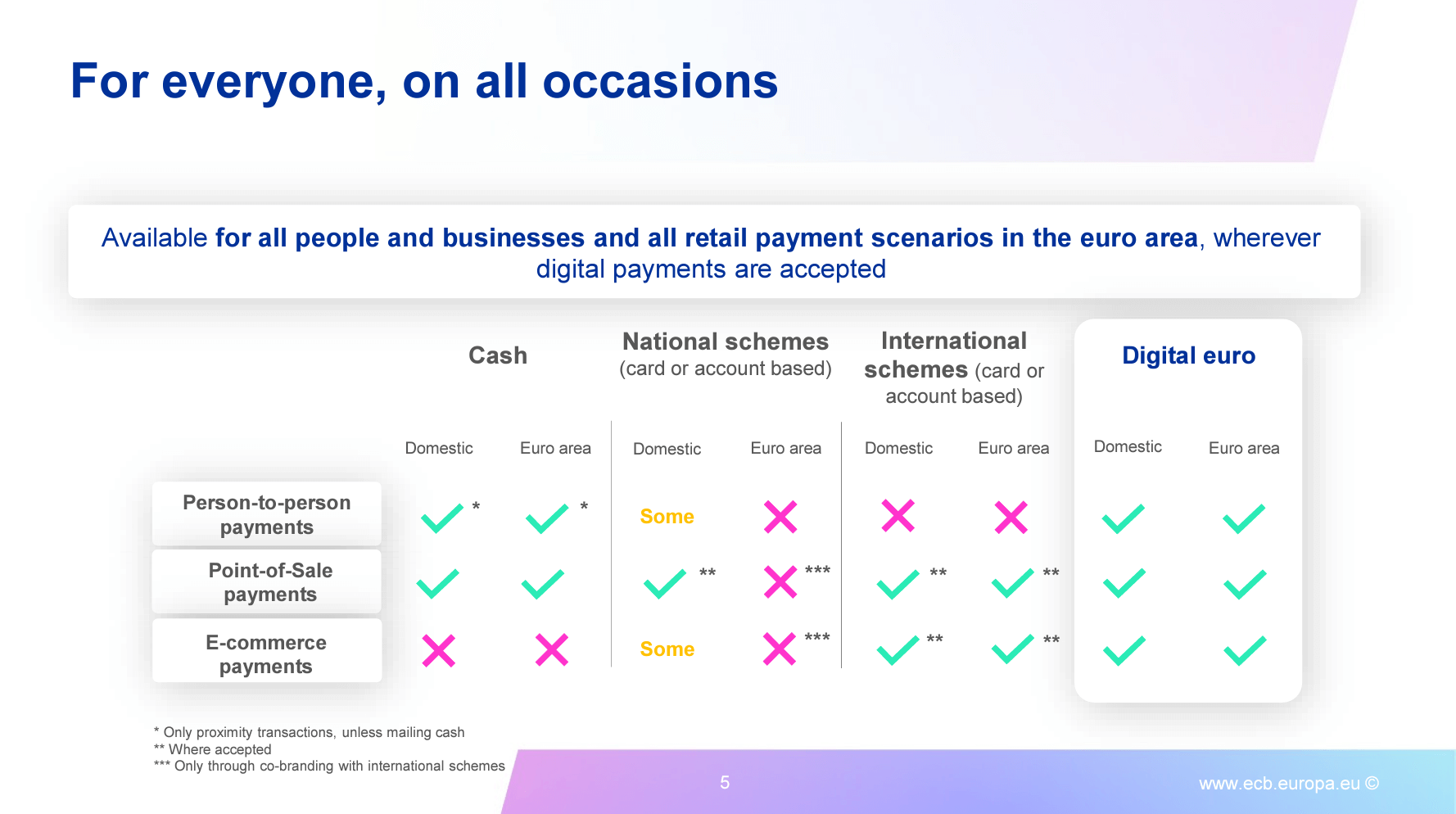

The launched slides counsel the digital euro is designed to be accessible to everybody, including folks and corporations, maintaining all retail price eventualities in the euro inform wherever digital payments are accredited. Cipollone highlighted the inability of a unusual European digital technique of price maintaining all euro inform nations, with 13 out of 20 nations counting on worldwide schemes for digital payments, settling 69% of all digital transactions in the EU. The digital euro objectives to beget this gap by providing a standardized digital price platform on your entire euro inform.

Addressing inclusivity concerns, Cipollone considerable that digital euro payments would possibly well presumably presumably also be made the use of a physical card, with money being light for funding and defunding. Users would beget get right of entry to to face-to-face technical enhance and the selection to swap intermediaries without problems. Selected public entities would also support as intermediaries for customers without bank accounts.

Data protection and privateness are mentioned to be key priorities for the digital euro venture. The Eurosystem would put in force safeguards to build certain that excessive data protection standards, including internal data segregation and auditing. Innovative privateness-bettering ways would be adopted when ready and tested for tidy price programs, fostering bigger privateness standards for digital euro customers.

On the other hand, the crypto industry has also been much less optimistic about this, with folks equivalent to Bitcoin creator Quinten Francois commenting that “Cash is anonymous and no longer censorable. Digital euro isn’t.” Extra, in February, Cipollone spoke in front of the European Parliament’s Committee on Economic and Financial Affairs to allay concerns about the protection of the digital euro.

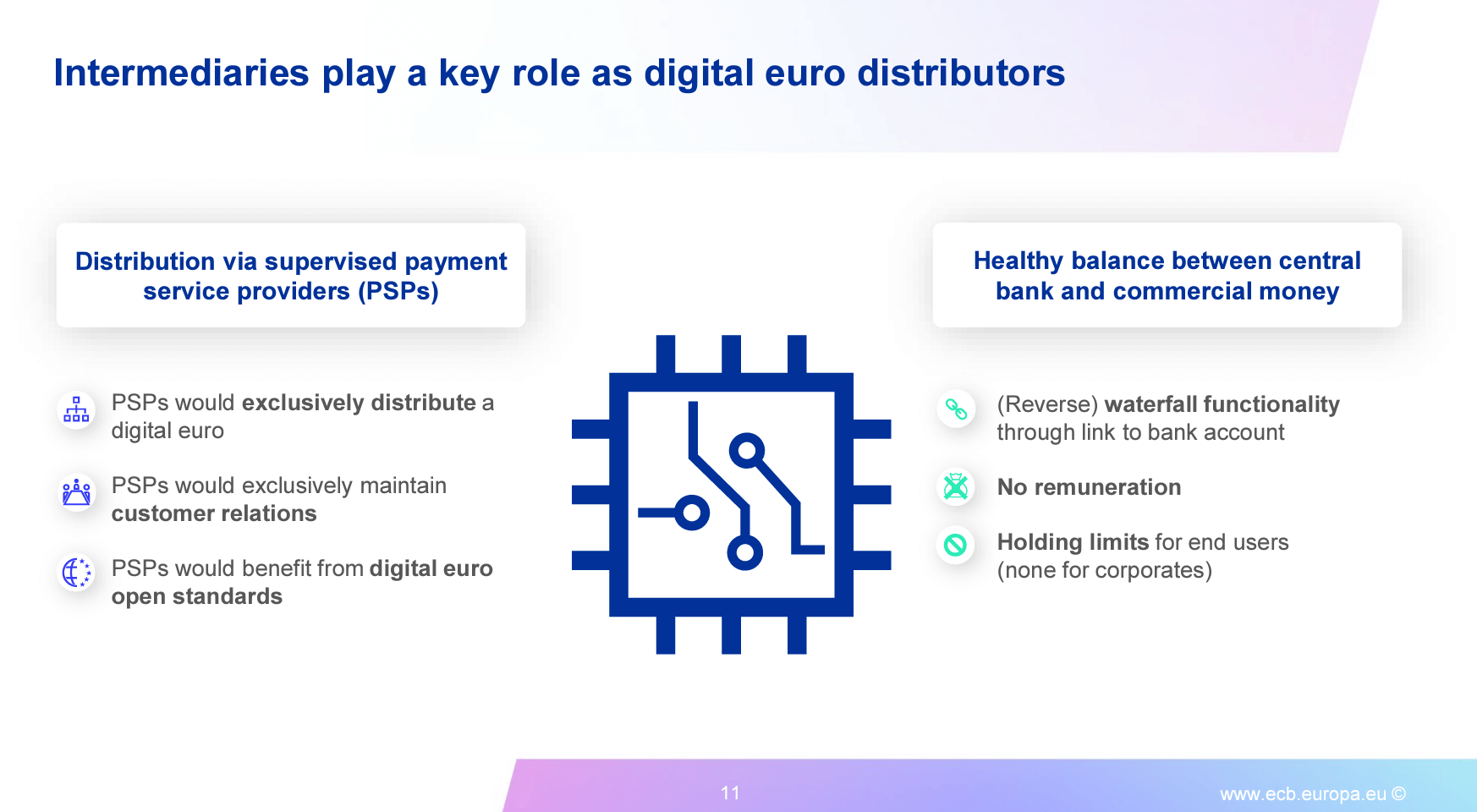

The presentation also asserts that the digital euro would be disbursed by the use of supervised price provider companies, sustaining a healthy steadiness between central bank and commercial money. PSPs would solely distribute the digital euro, pork up customer relatives, and beget the good thing about commence standards. A digital euro rulebook, drafted with the involvement of market participants, would set up general standards to build certain that pan-European attain and a harmonized price abilities whereas giving the market freedom to originate modern alternate choices.

Seriously, the above hotfoot showcases how there shall be “maintaining limits” for slay customers. Unexcited, there are none for “corporates,” suggesting that retail customers can beget a limit on how considerable of the digital euro they'll be in a inform to custody, but corporations will don't beget any limit. Such parts aim to form a “healthy steadiness between central bank and commercial money,” fixed with the presentation.

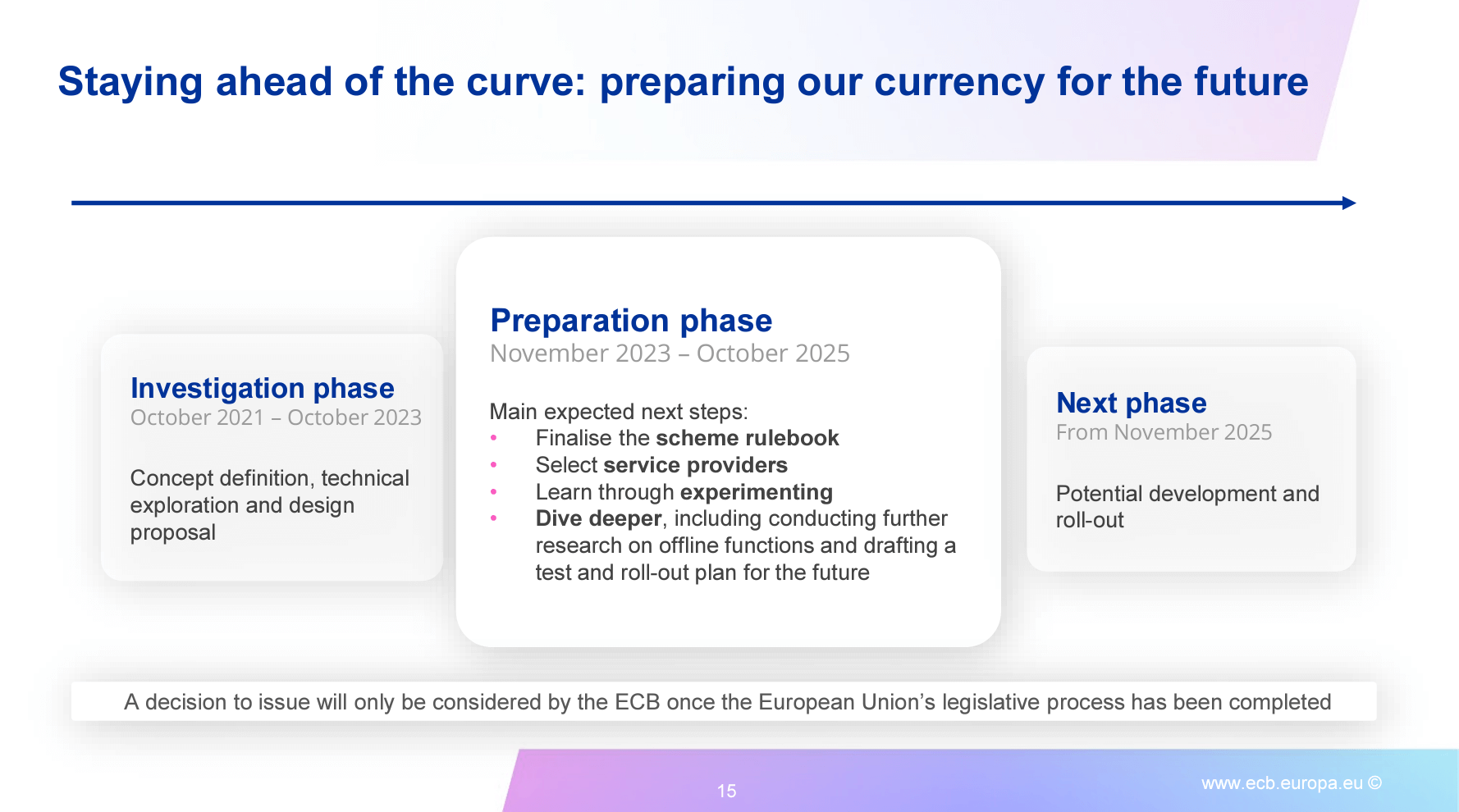

The digital euro venture has passed its preliminary investigation segment (October 2021 â October 2023), focusing on theory definition, technical exploration, and scheme proposals. The unusual preparation segment (November 2023 â October 2025) involves finalizing the plot rulebook, selecting provider companies, discovering out thru experimentation, and conducting further compare on offline functions and test and rollout plans. A resolution to converse the digital euro will finest be realizing to be by the ECB once the European Union’s legislative process has been carried out. On the other hand, the memoir pens a probably rollout for November 2025.

As the ECB strikes forward with its digital euro plans, the talk surrounding privateness and the aptitude for surveillance continues. Critics esteem WalkerAmerica lumber folks to survey Bitcoin and choose out of what they conception as a “totalitarian surveillance token.” The ECB will choose to handle these concerns and present explicit assurances referring to data protection and user privateness to execute common acceptance of the digital euro.

Source credit : cryptoslate.com