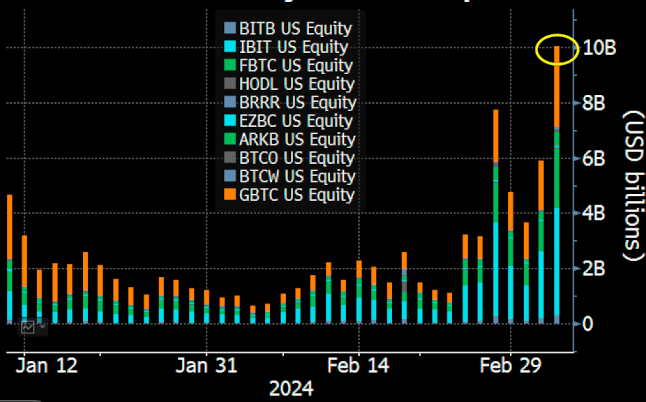

Spot Bitcoin ETFs record $10 billion in daily volume, breaking previous record

Situation Bitcoin ETFs enjoy persevered their anecdote-breaking efficiency this week, recording over $10 billion in quantity on March 5 — the very supreme since their open in January.

The old anecdote changed into gain on Feb. 28, when the ETFs recorded a collective shopping and selling quantity of roughly $7.7 billion.

IBIT, FBTC preserve the lead

Three dwelling Bitcoin ETFs made up a lot of the final quantity. Buying and selling closed with procure inflows of $109.86 million all the blueprint in which via all ETFs.

BlackRock’s iShares Bitcoin Belief (IBIT) changed into guilty for approximately $4 billion in quantity on March 5, while the Constancy Wise Starting gain apart Bitcoin Belief (FBTC) made up roughly $2 billion. Grayscale’s Bitcoin Belief (GBTC) recorded $3 billion in day-to-day quantity.

Bloomberg ETF analyst Eric Balchunas wrote on X:

“These are bananas numbers for ETFs below 2 [months] outdated.”

Earlier in the day, Balchunas predicted that dwelling Bitcoin ETFs would likely surpass their old anecdote as the final quantity reached $6 billion around 7:53 pm UTC.

Particular particular person ETFs destroy files

Balchunas illustrious that IBIT, FBTC, BITB, and ARKB all experienced anecdote day-to-day volumes.

He additionally noticed unheard of efficiency among several non-dwelling ETFs that enable for strategic investment. BetaPro Inverse Bitcoin ETF (BITI), the ProShares Bitcoin Approach ETF (BITO), and 2x Bitcoin Approach ETF (BITX) all saw anecdote volumes.

Several Bitcoin ETFs had been among the many most active ETFs basically. Recordsdata from Barchart indicates that IBIT and the BITO topped the list, surpassing the S&P 500 ETF Belief (SPY) and the Nasdaq QQQ Invesco ETF (QQQ). GBTC and FBTC additionally ranked among the many tip ten ETFs by quantity.

The Newborn 9’s unheard of efficiency has been a first-rate driver of Bitcoin’s most unique set surge as question outpaces supply. The flagship crypto hit a new all-time excessive earlier than the halving for the main time in its history.

All volumes coincide with Bitcoin (BTC) prices reaching new highs. BTC hasty touched $69,324 on March 5, surpassing its November 2021 all-time excessive of $69,044, earlier than a brutal set correction.

Source credit : cryptoslate.com