Celsius to unstake $470M Ethereum amid restructuring efforts, raising market concerns

Bankrupt crypto lender Celsius will unstake 206,300 Ethereum, fee round $470 million, as piece of efforts to facilitate the distribution of resources to creditors, in accordance with a Jan. 4 assertion on social media platform X (beforehand Twitter).

Celsius said the planned “considerable” unstaking occasion will occur in the next few days and extra published that its staked Ethereum holdings supplied the failed company a “helpful staking rewards profits” to offset decided charges incurred throughout its restructuring direction of.

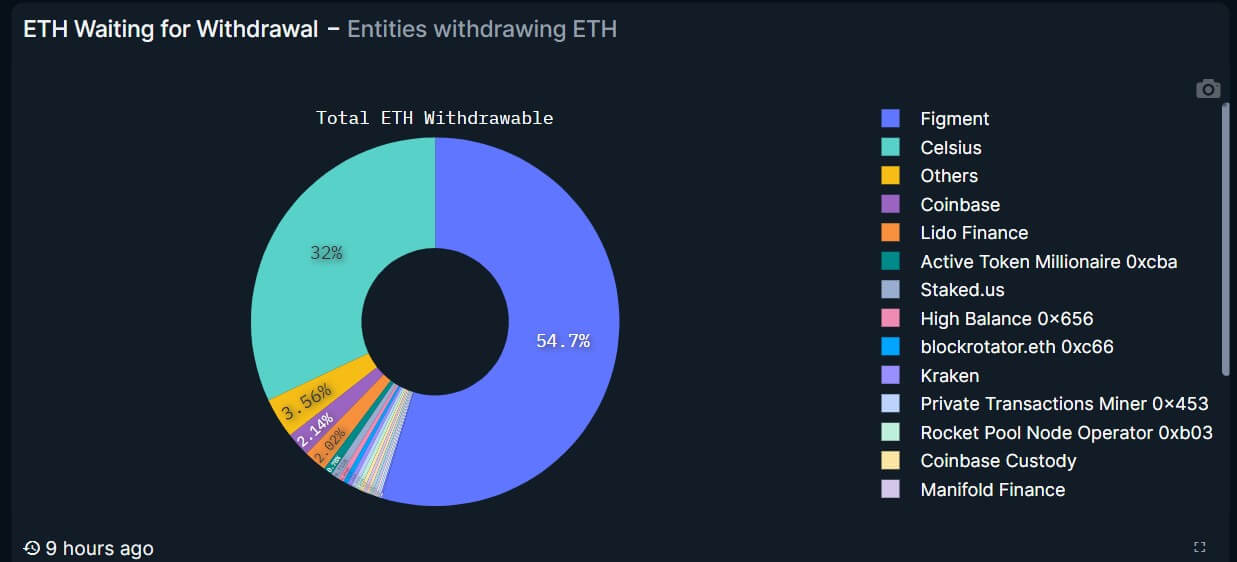

Following the ideas, Nansen’s Ethereum Shanghai (Shapella) Upgrade dashboard reveals that the lender desires to withdraw 206,300 ETH, or 32% of all ETH looking forward to withdrawal, valued at nearly $470 million.

The dashboard extra reveals that the firm is amongst the tip 10 firms which have withdrawn their staked ETH since withdrawals have been enabled final year. Celsius has withdrawn a total of 40,249 ETH as of press time.

Additionally, Celsius’s dedication has resulted in a indispensable surge in the Ethereum validator exit queue. Per data from beaconcha.in, the queue has spiked to over 16,000 in the present day time, a epic high, and the waiting time has prolonged to roughly six days.

In the intervening time, the sizzling announcement signifies progress in Celsius’s restructuring slither and the forthcoming return of customers’ resources. The court docket has already authorized a restructuring belief that could possibly well well allow creditors to recover as a lot as seventy nine% of their holdings.

Nonetheless, criticisms have emerged as a consequence of the absence of a disclosed effective distribution date, with prospects expressing weariness over chronic preparation updates.

What does this mean for ETH mark?

Crypto neighborhood contributors are concerned that Celsius’s switch could possibly well well amplify the selling stress on the second-greatest digital asset by market capitalization.

Closing December, CryptoSlate reported that the bankrupt lender purchased $250 million of digital resources, along with Ethereum, in 30 days. At the time, observers advised that the firm was once selling to capitalize MiningCo, a Bitcoin mining company that creditors of the failed firm would gain.

Nonetheless, Celsius said, “Eligible creditors will procure in-form distributions of BTC and ETH as outlined in the authorized Conception.”

Source credit : cryptoslate.com